-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

When a line PLC locks up at 2:00 AM or a drive fails on a critical conveyor, nobody on the plant floor talks about harmonized codes or export regulations. They just know every hour of downtime can burn thousands of dollars. Industry analyses from providers like ThroughPut.AI put unplanned downtime in some sectors at around $9,000 per minute when high-value assets are idle, and even more conservative estimates cited by Industrial Automation Co. mention situations where downtime easily exceeds $5,000 per hour. That is the financial backdrop for every international spare-parts shipment.

Shipping industrial automation parts across borders is not the same as sending consumer electronics. You are dealing with servo motors, PLCs with encryption, smart sensors, HMIs, and sometimes batteries or magnets that trigger hazardous goods rules. Many of these items are treated as ŌĆ£dual-useŌĆØ under export regulations, meaning they have legitimate industrial uses but potential military applications as well. Articles from Flash Global and Industrial Automation Co. both emphasize that missteps here can lead to seized shipments and fines that can exceed $1,000,000 per violation.

From an on-site engineerŌĆÖs perspective, the goal is simple: get the right part to the right machine, anywhere in the world, as fast as possible, without getting tangled in export law or customs. The solution is less simple. It combines correct classification, a solid compliance program, dangerous-goods discipline, accurate documentation, and a shipping model that reflects your downtime risk. The good news is that these steps are repeatable, and technology now does a lot of the heavy lifting if you set things up correctly.

Experienced service logistics providers like Flash Global hammer home a simple idea: the compliance work should be finished before the warehouse even prints a label. They structure their Export Management Systems around four questions that must be answered for every shipment: what is the item, where is it going, who will receive it, and what will they do with it. For automation spare parts, each of these questions has very specific implications.

At export, every part needs an Export Control Classification Number, or ECCN. This code, defined on the Commerce Control List, determines whether you can ship under a No License Required status or whether you need a formal export license. Flash Global points out that responsible OEMs maintain ECCNs on a Master Parts List so they do not have to figure this out from scratch for every order.

Industrial Automation Co. gives concrete examples that matter for automation engineers. High-power servo motors over about 500 W of output and PLCs that include robust encryption functions are classic dual-use candidates. These can fall under more stringent 600-series export controls or even ITAR-type regimes, meaning a license may be required even for purely commercial applications like a packaging line or bottling plant. The same article notes that many automation parts do in fact ship under No License Required, but only when the ECCN is accurate and the other conditions are satisfied.

The risk of getting this wrong is not theoretical. Industrial Automation Co. notes that misclassifying an itemŌĆÖs ECCN or related data can result in shipment seizures, extended delays, and penalties exceeding $1,000,000 per violation. They recommend using the U.S. Bureau of Industry and SecurityŌĆÖs SNAP-R system or qualified experts to validate ECCNs, especially for anything with nontrivial processing capability or communication security features. From a plant perspective, the impact is straightforward: one misclassified servo or CPU can turn a fast replacement into a multi-week shutdown.

The country of destination can be just as critical as the part itself. Flash Global notes that sanctions or embargoes against certain countries can prohibit shipments outright or trigger license requirements even for relatively simple spare parts. In parallel, Industrial Automation Co. highlights the role of Harmonized Tariff Schedule codes. HTS codes determine how customs classifies the item for duty and tax purposes and often influence whether additional controls apply.

In many cases, country-specific certifications layer on top of these requirements. Industrial Automation Co. calls out examples like CE marking in Europe or CCC in China, which can delay or block imports if missing. For temporary shipments such as demo units or short-term field trials, they cite the ATA Carnet as a practical tool to treat goods as temporary imports and avoid full duty and certification burdens. For automation OEMs, that can be the difference between a smooth demo tour and gear trapped in customs.

Flash Global stresses the need to screen every party in the transaction against denied or restricted parties lists. These lists, maintained by governments, include entities and individuals who cannot legally receive exports or even participate as intermediaries such as freight forwarders or logistics agents. If a buyer, consignee, or even a broker appears on one of these lists, the transaction cannot proceed. Their trade management systems perform automated checks against these lists before releasing a shipment.

Industrial Automation Co. adds another layer specific to U.S. law: anti-boycott rules. They warn exporters never to sign documents that include clauses committing to participate in a boycott of countries such as Israel. Agreeing to those terms in shipping documents is a violation in itself and can create severe legal exposure. It is exactly the kind of clause that slips into boilerplate paperwork if nobody with compliance experience reads it carefully.

Certain end uses are prohibited or highly restricted regardless of who is buying or where they are located. Flash Global notes regulations that bar exports for nuclear-related activities or missile construction without proper licensing. For automation spare parts, that tends to surface when you sell sophisticated motion control, advanced drives, or encrypted networking hardware into sensitive industries. A solid compliance program will collect and store end-use statements when necessary and will block shipments when red flags appear.

From an engineering standpoint, this may feel far removed from swapping a faulty drive in a bottling plant. But if your global support team sends a ŌĆ£standardŌĆØ servo pack to a customer in a sanctioned industry without checking end use, the shipment can be stopped and your company can find itself under investigation. That is why OEM-focused platforms like IntellinetSystemŌĆÖs Intelli Catalog integrate compliance workflows directly into ordering and export processes rather than leaving them as ad hoc email threads.

Even when export control is satisfied, customs classification determines duties, taxes, and sometimes whether the shipment clears at all. Industrial Automation Co. explains that every part must carry both an ECCN for export control and an HTS code for customs classification. Misalignment between those codes and the actual product is a common root cause of customs holds.

The same article explains that accurate commercial invoices, packing lists, and certificates of origin all tie back to these codes. Certificates of origin, for example, can unlock reduced duties under trade frameworks such as USMCA when filled out correctly. When defective U.S.-origin parts return for repair, Industrial Automation Co. notes that shippers may be able to re-import them duty-free using U.S. Customs Form 3311 if they come back within two years and are clearly marked ŌĆ£American Goods Returned ŌĆō No EEI Required (30.37(a)).ŌĆØ That kind of detail can save between zero and twenty-five percent of the shipment value in duties and brokerage fees.

For temporary exports, Industrial Automation Co. recommends using an ATA Carnet to classify goods as temporary imports. That approach is particularly helpful for loaner PLC racks, short-term test drives, or training equipment that will return to the home country. Without it, local authorities may insist on full import procedures, including certifications, duties, and sometimes lengthy inspections.

A lot of this can feel bureaucratic, but the underlying pattern is simple. Customs wants correct codes, honest values, clear origin information, and proof that the declared use matches reality. When automation manufacturers and integrators invest in clean part data and well-defined document templates, those checks become routine rather than painful.

One of the nastier surprises in international automation shipping is how often seemingly harmless parts fall under dangerous goods regulations. Industrial Automation Co. spells out the problem: lithium batteries and strong permanent magnets are common in automation and can trigger IATA and IMO Dangerous Goods rules.

They describe a real incident involving twelve Yaskawa servo motors rejected for excessive magnetization under air transport rules. The shipment had to be rerouted, generating more than $14,000 in additional air-freight costs alone. Nothing about those servos looked ŌĆ£hazardousŌĆØ to a technician; they were just standard drives for a machine. Yet because the magnetization levels exceeded thresholds and the shipment was not declared correctly, the airline treated the entire load as non-compliant.

Lithium batteries pose similar risks when embedded in HMIs, tablet-based programming tools, or smart sensors. If they are not classified, packaged, and labeled to dangerous goods standards, air carriers can refuse the shipment outright. In some regions, incorrect declarations can also lead to fines or blacklisting of the shipper.

Industrial Automation Co. strongly recommends performing a certified Dangerous Goods screening before any air or sea shipment that might contain magnets, batteries, or other regulated materials. In practice, that means building a simple but rigorous gate in your process. As soon as a part number is selected for an international shipment, your system or export coordinator should check whether it contains lithium cells, strong magnets, or other flagged materials and, if so, route the shipment through someone trained on IATA and IMO rules.

Most customs delays I see in the field have nothing to do with exotic regulations. They come from incomplete or inconsistent paperwork. Industrial Automation Co. provides a practical picture of what a correct documentation set looks like for automation spare parts.

A commercial invoice is the backbone. It must list the ECCN, HTS code, country of origin, and declared value for each line item. Vague descriptions like ŌĆ£automation componentŌĆØ are an invitation to scrutiny. A matching packing list should detail weight, dimensions, and piece count so customs can verify that what they see matches what is declared. Differences between paperwork and physical reality are one of the fastest paths to a manual inspection.

Certificates of origin come into play when you want to benefit from reduced tariffs under trade agreements. Without them, customs will typically assume a default or worst-case duty rate. For any shipment with hazardous elements such as lithium batteries or certain chemicals, Safety Data Sheets are mandatory. Industrial Automation Co. notes that an air waybill should be clearly marked ŌĆ£Repair/ReturnŌĆØ when sending used or defective items back for service, which can help both carriers and customs apply the correct rules.

These elements fit together in a repeatable pattern. Once they are standardized inside an OEM or integrator, they can be generated automatically. IntellinetSystemŌĆÖs Intelli Catalog, for example, supports automated commercial invoices, packing lists, and regulatory certificates as part of an integrated parts ordering workflow. One global automotive OEM reported roughly a thirty-five percent reduction in order-processing time within three months of deploying such a system, largely because manual document preparation and cross-checking were removed from the process.

The following table summarizes the core documents and their practical roles for automation spare parts:

| Document type | Primary purpose | Automation-specific note |

|---|---|---|

| Commercial invoice | Declare value, origin, ECCN, HTS to customs | List precise part numbers and descriptions for PLCs, drives, etc. |

| Packing list | Confirm weights, dimensions, and counts | Essential when shipping mixed pallets of drives, motors, and panels |

| Certificate of origin | Enable duty reductions under trade agreements | Particularly valuable for higher-value drives and motion packs |

| Safety Data Sheet (SDS) | Communicate hazards for batteries, chemicals, etc. | Required for lithium-powered HMIs or units with hazardous contents |

| Air waybill | Control transport instructions and special handling | Mark ŌĆ£Repair/ReturnŌĆØ and dangerous goods status clearly |

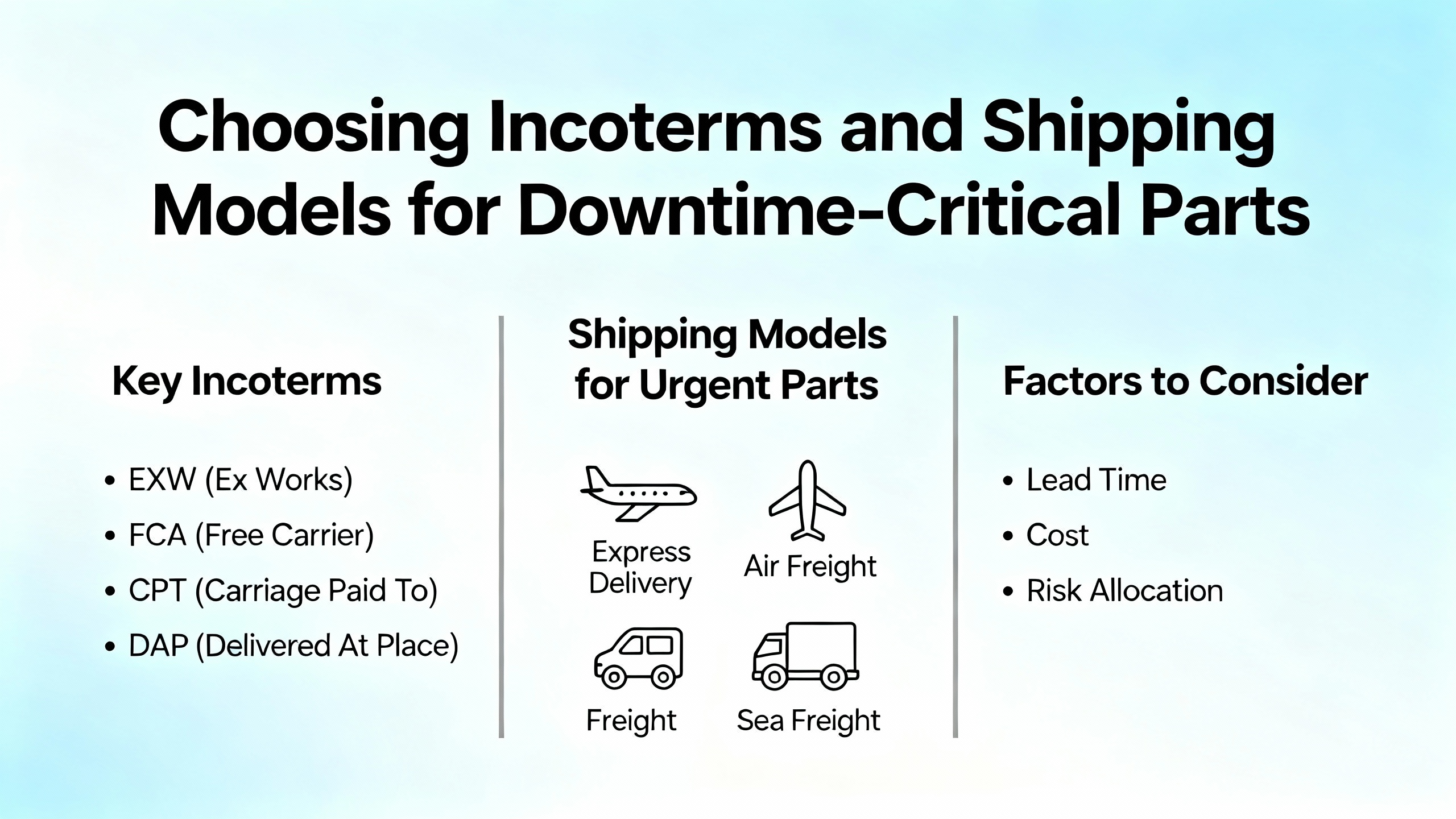

Even when paperwork is perfect, the way you structure risk and responsibility across the journey can make or break a time-critical shipment. Industrial Automation Co. explains that Incoterms define who owns transit risk, who pays which costs, and who is responsible for customs clearance at each leg of the trip. For urgent replacement parts, especially when downtime costs exceed $5,000 per hour, they recommend Delivered Duty Paid for many situations, using parcel carriers such as DHL or FedEx as the operational backbone.

Under a Delivered Duty Paid arrangement, the seller bears most of the logistics burden, including brokerage and export filings. The payoff is speed and predictability for the receiving plant. Instead of a maintenance manager in another country scrambling to find a local customs broker at midnight, the shipping carrierŌĆÖs network handles the clearance work. In practice, this approach works best when the seller has standardized export processes, validated HS and ECCN data, and clear instructions embedded in their shipping systems.

Broader logistics guidance from companies like Ziing and Spark Shipping underscores the value of multi-carrier networks. They point out that relying on a single carrier for all lanes can drive up cost and create vulnerability when that carrier has service issues. A technology-first shipping platform can match each movement to the most appropriate carrier based on size, weight, urgency, and route, while still honoring the Incoterms chosen for risk and cost allocation.

For automation spare parts, the choice often comes down to cost of delay versus cost of shipping. For a low-cost sensor that will not stop the line, deferred air or even sea freight may be acceptable. For a main drive or safety PLC that keeps an entire line down, same-day or next-flight-out under a risk-heavy term like Delivered Duty Paid is usually justified. The crucial point is that Incoterms and carrier choice should be deliberate, documented decisions, not whatever default a shipping clerk selects in a hurry.

The complexity of modern export rules and logistics networks is beyond what a single person with a spreadsheet can handle consistently. Fortunately, several layers of technology now help automation OEMs and operators manage international spare parts far more reliably.

Flash Global describes a robust global trade compliance program built around an automated Export Management System that tracks country-specific rules, maintains customer Master Parts Lists with ECCNs, and checks every shipment against that data before release. Their teams work with in-region Exporters of Record to ensure local compliance at destination. This kind of systematized approach turns the four key questions about the item, destination, recipient, and end use into a simple checklist that must pass before a package leaves the warehouse.

On the OEM side, IntellinetSystemŌĆÖs Intelli Catalog shows what happens when catalog management, order capture, and export documentation live in one platform. Their system gives dealers and distributors visual 2D and 3D diagrams, VIN or serial search, and smart text search, reducing misidentification and returns. Once the right part is selected, the system can generate destination-specific documents, support multi-language and multi-currency presentation, and integrate with ERP or dealer management systems. That combination reduces both shipping errors and export delays and, in one case study, cut export order processing time by about thirty-five percent within three months.

At the inventory level, AI-driven platforms like ThroughPut.AI focus on making sure the right parts are in the right region before you ever need to ship something overnight across an ocean. They ingest data from ERP, maintenance logs, and supplier performance metrics to forecast spare-parts demand and dynamically adjust safety stocks and reorder points. ThroughPut.AI reports results such as more than thirty percent reductions in excess inventory for a heavy equipment manufacturer, along with large reductions in avoidable ordering costs and emergency orders for automotive and aerospace customers. The practical effect for an automation engineer is fewer emergency international shipments and better odds that a critical part is already sitting in a nearer regional warehouse.

On the customs side, FreightAmigoŌĆÖs analysis of evolving 2025 automotive shipping rules highlights how AI-supported HS classification, automated rules-of-origin calculations, and digital documentation streamline compliance. As major markets revise HS and HTS codes and tighten environmental and safety regulations, the ability to keep classification accurate in real time becomes essential. Digital logistics platforms now combine that with route optimization, real-time compliance checks, and automated customs workflows, reducing the risk that a shipment is delayed because a code changed just before departure.

Finally, general spare-parts management guidance from SCMDojo and others emphasizes that the best shipping strategy is to need fewer emergency shipments. By treating spare parts as a strategic asset, setting clear reorder points, auditing inventory accuracy, and tying preventive maintenance to parts planning, plants reduce the odds that they must rush-ship a drive or PLC from another continent in the first place.

Consider a scenario many of us have seen: a high-speed packaging line in Mexico goes down because the main servo drive fails, and the only spare is in your U.S. warehouse. Production is halted; every hour down is burning thousands of dollars in lost output and labor. How should the shipping process run if your systems and processes are mature?

The first move is to identify the exact part using an authoritative, illustrated catalog rather than an email description. Platforms like Intelli Catalog make this step faster and more reliable by letting a technician confirm the drive visually, by serial number, or via exploded diagrams. Once the correct part number is selected, your system should immediately pull the ECCN and HTS code from the Master Parts List and confirm whether the drive is dual-use. If there is any doubt about the ECCN, a compliance specialist can validate it through the SNAP-R system before you commit to a shipment.

Next, the destination, recipient, and end use must be cleared. The Export Management System checks whether the Mexican plant or its parent company appears on any denied or restricted party lists and verifies that Mexico is not subject to embargoes relevant to this drive. If the customerŌĆÖs documentation includes any unusual clauses, such as boycott language, those are flagged and corrected. At the same time, the customs module ensures that the HTS code is valid for Mexico and determines any likely duties and taxes.

In parallel, the warehouse confirms whether the drive contains magnets or batteries that might trigger dangerous-goods rules. If it does, a trained coordinator prepares the correct labels and packaging according to IATA guidelines and attaches the necessary Safety Data Sheets. Industrial Automation Co.ŌĆÖs documented experience with rejected servo shipments shows why that extra ten minutes of screening is worth it.

Documentation is then generated in one shot: a commercial invoice with ECCN, HTS, origin, and value; a packing list with accurate weights and dimensions; any needed certificates of origin; and an air waybill clearly describing whether this is a sale or a repair or return. If the drive is a U.S.-origin unit sent out previously and now returning for warranty testing, customs Form 3311 and the ŌĆ£American Goods Returned ŌĆō No EEI Required (30.37(a))ŌĆØ notation can be used to avoid unnecessary re-import duties.

Finally, logistics selects a shipping model that reflects downtime cost. Given the urgency, the company chooses Delivered Duty Paid via a carrier with strong cross-border capabilities. That means the U.S. exporter and the carrier handle export filings, customs brokerage, and duty payments. A pre-alert goes to the receiving plant with all tracking and customs references, as Industrial Automation Co. recommends. The plantŌĆÖs maintenance team can plan their repair window based on a realistic arrival time rather than vague promises.

When everything works like this, the line still goes down, but it does not stay down for days. More important, the process is repeatable. The same pattern applies whether the destination is in Europe, the Middle East, or Asia, with only the country-specific requirements and carriers changing.

Despite all the tools now available, I still see the same failure modes:

Shipments are built around informal part descriptions instead of validated part numbers, so the wrong drive or PLC is shipped, and everything has to be redone. ECCN and HTS codes are guessed at or copied from similar parts rather than confirmed, leading to holds and, in the worst cases, compliance investigations. Export documents slip in anti-boycott clauses that nobody notices until legal or compliance flags them after the fact. Dangerous goods are not screened properly because the part ŌĆ£just looks like a motor,ŌĆØ and then an airline rejects the load for magnetization or undeclared batteries, echoing the twelve-servo incident Industrial Automation Co. describes. Country certifications like CE or CCC are treated as afterthoughts, so parts arrive at the border and sit in limbo. For temporary demo or loaner units, nobody uses ATA Carnets or duty-relief mechanisms, so the cost of customs and paperwork makes the entire exercise uneconomical.

In many plants, spare-parts inventory is not aligned with maintenance strategy, so they rely on emergency international shipments far more often than necessary. Analyses from SCMDojo and ThroughPut.AI highlight how poor data quality, inconsistent records, and reactive maintenance drive both overstocking and stockouts. The result is a paradox: racks full of the wrong spares and none of the one part you actually need on a critical night.

The encouraging part is that every one of these problems is fixable with process discipline and modest investment in the right tools and training.

You do not have to become a trade lawyer or dangerous-goods officer to ship automation spare parts internationally, but you do need to know when to ask for help. Flash Global positions its trade operations and global compliance teams, together with in-region Exporters of Record, as a way to outsource much of the compliance complexity. Industrial Automation Co. combines global sourcing, U.S.-based inventory, and export documentation support to give customers the ability to source drives, PLCs, and other spares worldwide without building a full in-house compliance department.

On the logistics side, companies like Ziing emphasize multi-carrier, data-driven delivery networks for automotive and industrial parts. Spark Shipping focuses on inventory synchronization and fitment accuracy for auto parts, which has parallels in automation where compatibility between drive, motor, and mechanical load is critical. Digital freight platforms such as those profiled by FreightAmigo use AI and automation to keep up with fast-changing HS code regimes and environmental regulations, particularly as electric-vehicle components and other advanced technologies introduce new hazards and restrictions.

The underlying pattern is clear. If you ship occasionally and only to a few familiar destinations, you might manage with a lean internal team and careful use of official tools like SNAP-R. Once your export footprint grows or your product catalog includes dual-use or hazardous parts, partnering with a specialist becomes a practical necessity.

According to Industrial Automation Co., most commercial automation parts ship under a No License Required status, provided the ECCN is correctly assigned, the destination country is not subject to relevant controls, the recipient is not on a denied parties list, and the end use is not restricted. The exceptions tend to involve higher-power servo motors, encryption-capable PLCs and controllers, or shipments into sensitive regions or industries. That is why both Flash Global and Industrial Automation Co. stress proper ECCN determination and, where appropriate, validation through official tools such as SNAP-R.

Not always, but often. When downtime costs run into thousands of dollars per hour, as cited by Industrial Automation Co. and other MRO-focused analyses, the incremental cost of same-day or next-flight-out air freight is frequently justified. The key is to reserve those options for truly line-stopping parts: the main drive, safety PLC, or key motion module that prevents production from running. Lower-impact spares can move on slower, cheaper modes. AI-based planning tools from vendors like ThroughPut.AI can help identify which parts are so critical that they should either be stocked regionally or moved by the fastest possible service when needed.

The minimum viable check, drawn from the combined guidance of Flash Global and Industrial Automation Co., is to confirm three things: the partŌĆÖs ECCN and HTS code are validated and recorded in your Master Parts List; the destination country and all parties involved pass denied-party screening; and the part does not contain undeclared dangerous goods such as lithium batteries or strong magnets. If you cannot clear those three quickly and reliably, your process needs work. Once they are in place, the rest of the documentation and Incoterm decisions can be standardized, making emergency shipments a controlled process rather than a gamble.

On the plant floor, your customer only sees whether the line is running. Behind that simple outcome sits a complex chain of export controls, customs rules, hazardous-goods regulations, and logistics decisions. International shipping solutions for automation spare parts work best when compliance, documentation, and logistics are treated as part of the engineering problem, not someone elseŌĆÖs paperwork. If you build clean part data, disciplined processes, and a small network of expert partners now, your next midnight call about a failed drive will be stressful for all the right reasons, not because customs seized the only spare you had.

Leave Your Comment