-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

Unplanned downtime feels different when you are the person standing under a silent gantry crane or a dead conveyor, with production supervisors checking their watches. As an industrial automation engineer, I have had nights where a single PLC power supply or failed HMI decided whether we shipped on time or lost tens of thousands of dollars before sunrise. In that moment, the only question that really matters is simple: can we get the right automation part, today?

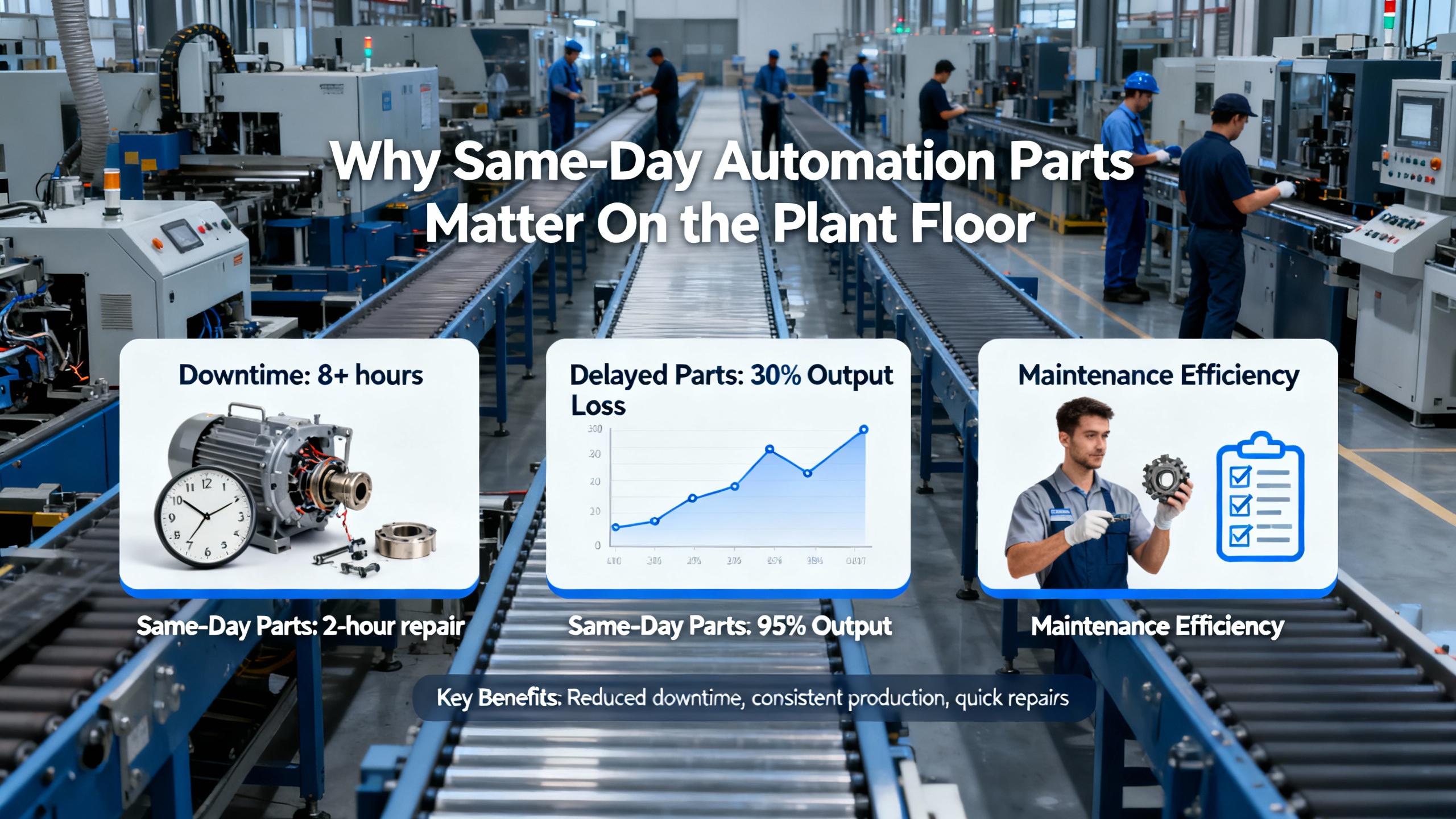

Same-day delivery for automation parts is no longer a nice-to-have. Research on manufacturing logistics shows that a single hour of unplanned downtime can cascade into missed customer deadlines, penalty clauses, and lost business, and a case highlighted by a Massachusetts same-day courier showed an estimated $50,000 in avoided losses when a failed CNC component was sourced and delivered within three hours instead of waiting the typical 48-hour lead time. When you combine that kind of impact with lean and Just-in-Time practices that intentionally keep inventory low, same-day parts are now a strategic capability, not just a convenience.

This article walks through how same-day delivery for automation parts really works, how to design your plantŌĆÖs parts strategy around it, and how to avoid the quality and logistics traps that can turn a ŌĆ£rushŌĆØ order into a second failure.

Downtime has always been painful, but modern manufacturing amplifies it. Lean and Just-in-Time practices have trimmed on-site spare inventories so plants can free working capital and avoid obsolete stock. The trade-off is dependency on ultra-reliable logistics and fast access to parts.

In practice, that means a failed PLC, VFD, servo amplifier, or HMI can halt a line where there is no local spare. A specialty courier article on manufacturers stresses that even an hour of unplanned downtime can trigger major revenue loss and contractual penalties, and same-day parts delivery is explicitly described as a strategic necessity, not an emergency luxury. Another manufacturer in Waltham avoided an estimated $50,000 in losses when a same-day courier sourced and delivered a failed CNC component in three hours; under a traditional 48ŌĆæhour replacement lead time, production and commitments would have been severely impacted.

At the same time, last mile logistics is the most expensive part of the supply chain. Industry analysis cites roughly 41% of total logistics cost in the last mile versus about 13% for warehousing. That cost pressure is a big reason why same-day delivery must be engineered, not improvised. To be sustainable, same-day parts require tight integration between your suppliersŌĆÖ inventory systems, warehouse automation, and highly automated last mile dispatch, routing, and tracking.

For factory automation teams, the key takeaway is simple. Same-day parts are the safety net that makes lean inventory realistic. Without them, your ŌĆ£efficientŌĆØ inventory strategy can turn into an uptime liability the first time a legacy drive fails or an obsolete CPU dies.

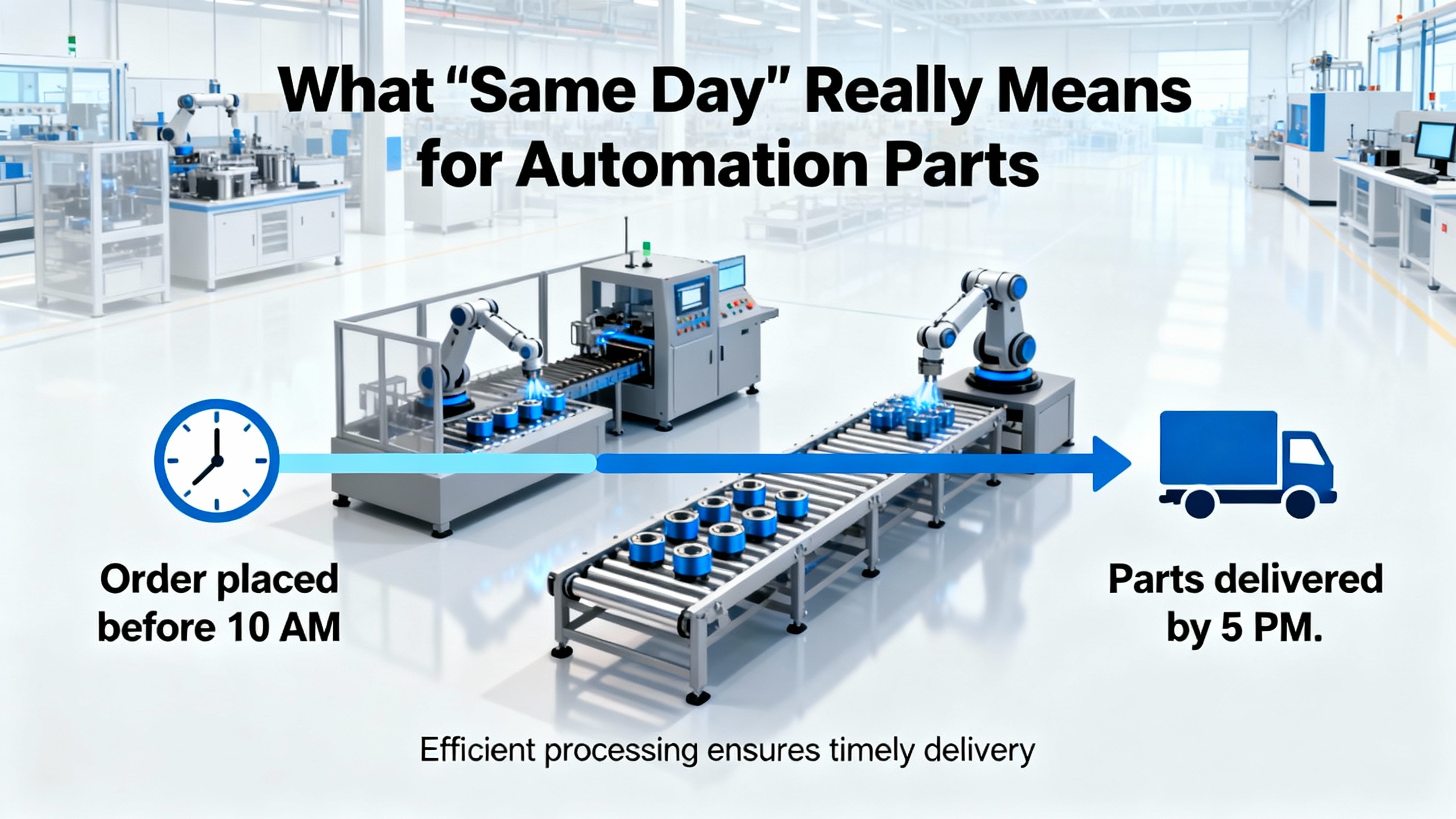

From an operations standpoint, ŌĆ£same dayŌĆØ has several layers, and understanding them helps you design realistic maintenance and logistics plans.

Some industrial couriers offer speed tiers. In Massachusetts, one specialized courier highlights a two-hour emergency option, same-day service windows, and clear cut-off times, such as a 2:00 PM deadline for certain regional same-day deliveries. This structure is typical: emergency tiers carry higher cost but can cover situations where an entire line is down; standard same-day slots handle urgent but not catastrophic failures.

On the parts side, companies like Industrial Automation Co. explicitly focus on emergency replacement of drives, PLCs, and HMIs with typical delivery windows of 24ŌĆō48 hours and same-day shipping for orders placed by mid-afternoon Eastern time. They combine this with a two-year warranty and free technical support, positioning the service as an alternative to OEM lead times that can stretch into weeks. Case studies include a food processor in North Carolina where a failed Siemens drive threatened about $50,000 in lost product until an overnight replacement restored operations in under 24 hours, an automotive plant in the Midwest that recovered from an Allen-Bradley PLC failure in less than 36 hours, and a Texas packaging facility that avoided a six-week OEM HMI lead time through same-day shipment.

There is also a class of ŌĆ£need-it-nowŌĆØ automation suppliers such as DO Supply that position themselves as global leaders in urgent replacement parts and repairs for PLCs, drives, motors, and HMIs, emphasizing fulfillment speed and technical support. Their role is to maintain the inventory depth and repair capability that OEMs often phase out for older product families.

Finally, providers like Next Day Automation promote same-day delivery as a customer-facing service for automation components, supported by trained, knowledgeable staff who can guide part selection and shipping options when time is tight.

In other words, ŌĆ£same dayŌĆØ is a composite of fast inventory access, cut-off times, and specialized logistics. To benefit from it, you need all three.

Fast delivery does not matter if nobody actually has the part.

This is where large-scale MRO and automation part aggregators change the game. ASC Global, for example, advertises real-time access to more than seven million stocked parts, sourced from over 1,000 vetted manufacturers and valued at over $1 billion. That depth matters when you are hunting for a specific safety relay, a rare HMI panel, or a discontinued servo module. By centralizing maintenance, repair, and operations (MRO) and automation part sourcing, these aggregators reduce supplier risk, shorten qualification cycles, and make it realistic to treat same-day and next-day sourcing as standard operating procedure.

Equally important are their compliance and traceability practices. For regulated industries, documented adherence to standards and component traceability through the supply chain is non-negotiable. Providers like ASC Global explicitly emphasize compliance and full component history so you can pass audits and root-cause investigations without scrambling for paperwork.

In my experience on audits and post-failure investigations, knowing exactly where a replacement drive came from, how it was tested, and how it was stored is the difference between a clean close-out and weeks of painful back-and-forth with quality, safety, and insurance teams.

Under pressure, part identification is where everything often falls apart. A technician on a noisy floor calls a supplier, tries to describe ŌĆ£the small blue module, third from the left in the cabinet,ŌĆØ and two days later you receive a similar but incompatible variant. That is not a logistics problem. It is a data problem.

Some equipment builders design around this failure mode. Creative Automation assigns a unique Custom Part Identification Number to every custom part in its machines and physically stamps that ID on the part at the factory. When a customer calls in with the stamped ID, the team can immediately pull up the exact design details without guesswork, manufacture a replacement, and often ship the correct component the same day. A five-minute phone call with a clear ID can save thousands of dollars in downtime, and their core recommendation is to rely on the stamped ID rather than verbal descriptions.

The lesson applies far beyond custom-built machines. In a plant that depends on same-day parts, you want every critical component to be unambiguously identifiable under stress. That means clear labeling in the panel, reliable as-built and as-maintained documentation, and a single source of truth for part numbers, firmware versions, and configuration notes. When you combine that data hygiene with suppliers who can map your identifiers to their catalogs, you unlock the real value of same-day fulfillment.

Same-day delivery works best when it is built into your maintenance and automation strategy rather than treated as a last-minute rescue. Several practical elements show up consistently in both research and field experience.

A first pillar is understanding your critical components and obsolescence risk. Industrial Automation Co. emphasizes the need to identify mission-critical PLCs, VFDs, HMIs, and servo drives that are near end-of-life and to document part numbers, firmware, and configurations. Many PLCs, for example, have a lifecycle on the order of ten to fifteen years before support declines. They recommend a thorough audit of the production line and a detailed inventory that also tracks serial numbers, installation dates, maintenance history, and expected lifespan based on manufacturer data. When you categorize components by risk level and monitor OEM endŌĆæofŌĆælife announcements, you can plan upgrades or targeted stockpiles instead of getting surprised by sudden obsolescence.

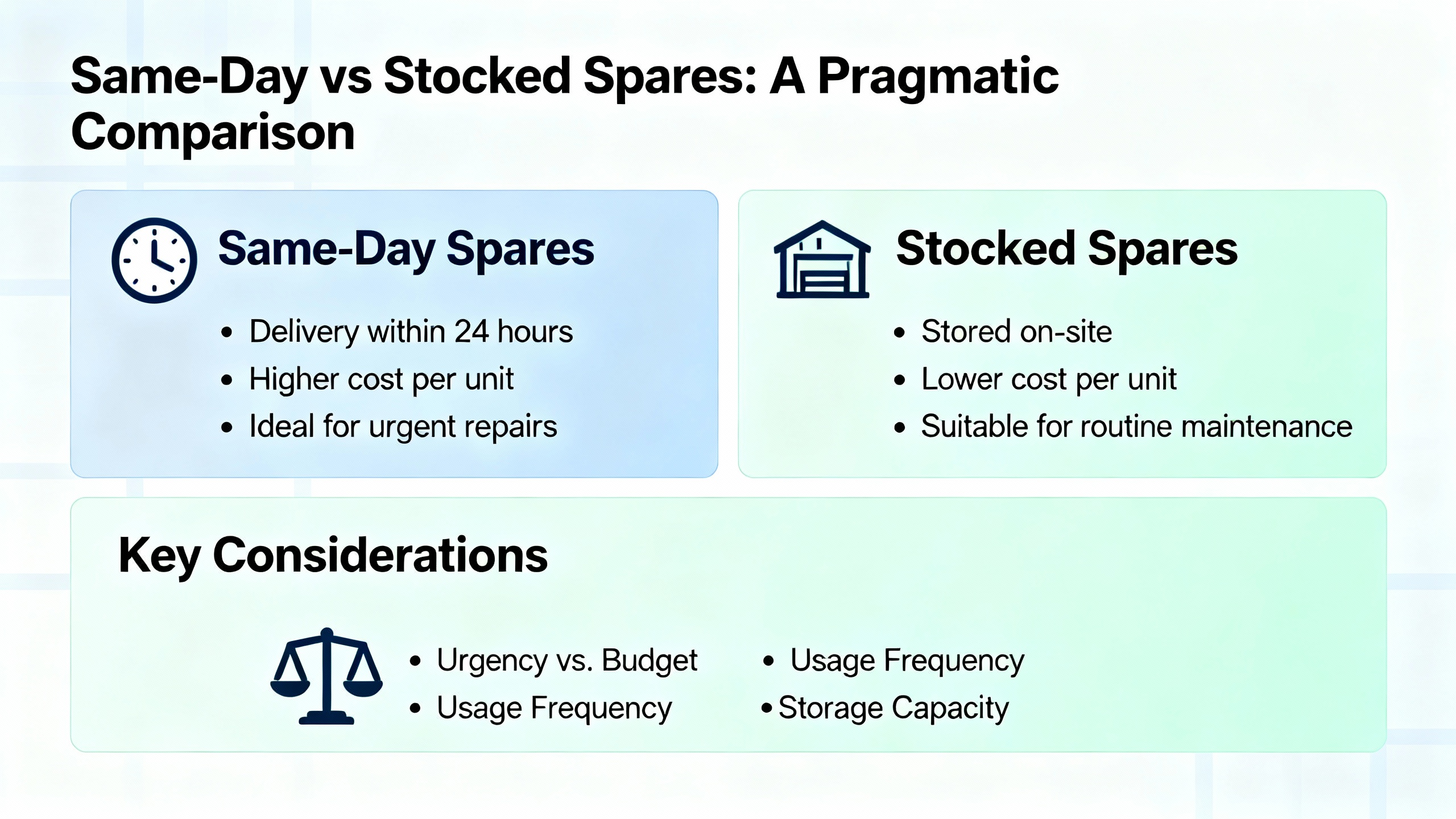

A second pillar is choosing the right mix between on-site spares and reliance on fast external sourcing. Lean and Just-in-Time manufacturing rely on ultra-reliable logistics so that plants can minimize on-site inventory, reduce buffer stocks, and free working capital while still receiving critical parts exactly when needed. Same-day parts and specialized couriers are the safety net that makes this possible, but they do not remove the need for any local stock. For truly singleŌĆæpointŌĆæofŌĆæfailure items with no quick retrofit, I still recommend holding at least one tested spare on-site and relying on same-day sources for the second or third level of redundancy.

A third pillar is defining your supplier ecosystem before you are in crisis. Industrial Automation Co. positions itself as a specialist in hard-to-find obsolete parts, with global sourcing, testing, and a two-year warranty. DO Supply presents itself as a global leader in urgent automation replacement and repair, focused on PLCs, drives, and HMIs. ASC Global centralizes MRO and automation inventory at massive scale with strong compliance and traceability. PLM Companies emphasizes a full-service parts and repair team that helps customers identify and select the right replacement for packaging equipment rather than just shipping a catalog item. BoxLogix focuses on tailored material-handling automation designed around lean manufacturing and traceability. None of these eliminate the need for OEM relationships, but they give your maintenance team multiple paths to a working part.

The last pillar is quality assurance. Industrial Automation Co. highlights multiŌĆæpoint functional testing and a roughly 24ŌĆæmonth warranty on most products, covering major brands such as ABB, Mitsubishi, and Allen-Bradley. They encourage customers to ask detailed questions about how testing is done, whether it is in-house or through certified labs, and to request test reports or references. This focus is not academic. Counterfeit or poorly refurbished automation parts are a real risk; using them can lead to repeat failures, safety issues, or insurance problems. In my own projects, I treat proof of testing and a meaningful warranty as mandatory for any part that will sit in a critical protection or control loop.

From the outside, same-day delivery looks like a fast van, a helpful driver, and a tracking link. Under the hood, it is an automation problem.

Research on warehouse and logistics automation points out that manufacturing performance is tightly coupled to warehousing. A paper from a supply-chain program at a major university explains that poor inventory accuracy or delayed material flows from warehouses can idle machines, trigger wrong-part production, and increase changeovers, all of which reduce Overall Equipment Effectiveness. To combat this, warehouses are shifting toward high-velocity, automation-heavy models.

Automated Storage and Retrieval Systems, conveyor systems, autonomous guided vehicles, and warehouse execution software all play a role. Studies from logistics providers and automation companies show that AS/RS combined with high-density racking can enable lights-out operation, with pallets and totes moving in and out of storage with minimal human intervention. Automated conveyor networks with controlled acceleration and ŌĆ£zero pressureŌĆØ logic reduce product damage and maintain smooth flows between docks, storage, and production. Warehouse execution systems, integrated with barcode or RFID tracking, provide real-time stock visibility and automatic allocation of inventory for urgent orders.

Vendors like AutoStore highlight how such systems change performance. In one Siemens site, implementing AutoStore resulted in picking that was reported as 78% faster along with significant cost savings. A global distribution center for SMC doubled daily throughput using similar automation. Those numbers matter when you are trying to pull a specific drive or PLC out of a crowded warehouse and prepare it for same-day shipping. The warehouse backbone must be able to find, pick, pack, and hand off your part to a truck or aircraft within hours.

At the same time, last mile automation is attacking the 41% cost share of final delivery. Logistics providers and technology firms emphasize AI powered route optimization, dynamic dispatch, and real-time monitoring. One delivery automation article describes software that continuously optimizes routes based on traffic and weather while reallocating work when a driver is delayed. Another source notes that about 96% of consumers define ŌĆ£fastŌĆØ delivery as same-day, so the bar for performance is high. Companies like DispatchTrack argue that success requires centralized, automated management of trucks, inventory, and warehouse locations, while a logistics insights piece from Goodman highlights legged and wheeled robots, drones, and autonomous vehicles as emerging tools for sameŌĆæday last mile delivery, even though many are still in trial phases.

When you look at same-day automation parts from the plant floor, what you are really seeing is a long chain of automation and data integration that stretches from your CMMS through a supplierŌĆÖs warehouse and into last mile routing software.

Different plants will land at different places on the spectrum between heavy on-site spares and heavy reliance on same-day logistics. It helps to compare the approaches in a structured way.

| Approach | Advantages | Risks and Trade-offs | Best Fit Scenarios |

|---|---|---|---|

| Heavy on-site spares | High autonomy and minimal dependence on external logistics during failures; immediate access for common breakdowns; easier to support remote or hard-to-reach sites. | Tied-up working capital, risk of obsolete stock, storage and maintenance overhead; greater chance that parts age out or become unsupported. | Remote sites, safety-critical operations, or facilities with poor logistics access where same-day is unrealistic. |

| Hybrid: limited spares plus same-day | Balances on-site coverage for singular critical items with leaner inventories and reliance on same-day for everything else; aligns well with Just-in-Time principles. | Requires disciplined supplier relationships and clear playbooks for when to trigger same-day orders; still some carrying cost for on-site spares. | Most medium to large plants in dense logistics regions where specialist couriers and large aggregators can reach within hours. |

| Minimal spares and full same-day reliance | Lowest inventory cost and maximum flexibility; minimal risk of holding obsolete components; leverages specialist aggregatorsŌĆÖ deep inventories. | High dependency on logistics performance, weather, and carrier capacity; increased vulnerability during regional disruptions; premium shipping costs for frequent emergencies. | Highly urban plants with multiple nearby warehouses and couriers, plus very robust supplier relationships and strong risk tolerance. |

As an on-site engineer, I rarely recommend the extremes. A hybrid strategy, built around a clear list of ŌĆ£no excusesŌĆØ components that you hold locally and a larger list you plan to source on a same-day or 24ŌĆō48 hour basis, usually gives the best balance of uptime and cost.

The value of same-day parts becomes obvious when you put it in the context of real incidents.

The precision manufacturer in Waltham described earlier faced a failed CNC component with a standard replacement lead time of 48 hours. Using a same-day courier that specialized in manufacturers, they sourced the component and delivered it within about three hours, avoiding an estimated $50,000 in losses. That kind of delta is not unusual when you consider labor, scrap, missed shipment windows, and possible penalty clauses.

Industrial Automation Co. shares several case examples. A food processor in North Carolina faced a failed Siemens drive that threatened roughly $50,000 in lost product. An overnight replacement from emergency inventory restored operations in under 24 hours. An automotive plant in the Midwest experienced a production line stoppage due to an AllenŌĆæBradley PLC failure; in-stock parts and express shipping had the line running again in less than 36 hours. A packaging facility in Texas avoided a sixŌĆæweek OEM lead time for an HMI by sourcing an equivalent via same-day shipment, preventing a prolonged and costly shutdown.

On the logistics side, Reliable Couriers positions same-day rush delivery of manufacturing and production line parts as missionŌĆæcritical, with nationwide coverage through hubs and a diverse fleet that can handle everything from small electronics to larger bulk shipments. They emphasize trained drivers, safe handling, and temperature-controlled transport for sensitive items, along with real-time GPS tracking so customers can monitor urgent shipments. Their framing is clear: rapid pickŌĆæup and delivery of critical parts turns what could be a major production crisis into a short disruption.

As these scenarios show, same-day parts are not just about convenience. They reshape the risk profile of your automation systems and maintenance plans.

Obsolete components are where same-day parts become especially valuable and especially tricky.

Industrial Automation Co. defines obsolete automation parts as components no longer produced or fully supported by OEMs, including older PLCs, VFDs, HMIs, and servo drives. They point out that sourcing endŌĆæofŌĆælife components requires precision and speed. Their recommended practices include a thorough audit of mission-critical equipment, detailed inventories, and continuous monitoring of endŌĆæofŌĆælife announcements from major manufacturers such as Rockwell Automation and Siemens. Asset management tools can help track usage patterns and set alerts for components approaching obsolescence.

Inventory strategy for obsolete parts is nuanced. The guidance from Industrial Automation Co. suggests a mixed approach: use JustŌĆæinŌĆæTime ordering for non-critical parts while maintaining a small buffer of highŌĆærisk obsolete components, particularly those without dropŌĆæin replacements. Their buyback and surplus programs also illustrate a way to monetize idle stock. By selling surplus legacy drives, amplifiers, or modules into a specialistŌĆÖs network, plants participate in a circular economy that reduces waste and makes rare components available to others.

In my own work, the most successful obsolete parts strategies combine three elements. First, a living register of all endŌĆæofŌĆælife or soonŌĆætoŌĆæbeŌĆæendŌĆæofŌĆælife components. Second, a short list of preŌĆæqualified retrofit solutions and partner integrators who can help migrate to newer platforms. Third, at least one trusted specialist supplier who can provide same-day or 24ŌĆō48 hour access to tested legacy parts with solid warranties while you execute longer-term migration plans.

Same-day delivery of automation parts is not a stand-alone service. It is part of a broader shift toward automated, data-driven logistics and maintenance.

Warehouse automation research emphasizes that upstream raw material warehouses and downstream finished goods centers are becoming more automated, with functions such as storage, picking, packing, and dispatch supported by AS/RS, conveyors, AGVs, and warehouse execution systems. Logistics automation providers note that automation is most cost-effective for repetitive tasks like inserting and extracting goods in storage, order preparation, and internal stock movements. Order picking is moving from personŌĆætoŌĆægoods toward goodsŌĆætoŌĆæperson models, driven by WMS software and technologies like pickŌĆætoŌĆælight and pickŌĆæandŌĆæplace robots.

At the same time, manufacturing logistics frameworks such as the planningŌĆōimplementationŌĆōcontrol cycle described in AutoStoreŌĆÖs guidance highlight the need for integrated information and control systems. Planning covers forecasting and risk management. Implementation covers inventory tracking, production scheduling aligned to demand, and integration of technologies such as AS/RS, ERP, and IoT. Control is about monitoring key performance indicators like delivery lead times, production costs, and inventory turnover, and using continuous improvement to remove bottlenecks.

Last mile automation research, from sources like MarketStar and others, frames on-demand and same-day delivery as part of a booming platform-driven economy, with strong emphasis on real-time visibility, analytics, and mobile-first customer experiences. Automation reduces manual dependencies in scheduling, task allocation, route planning, and dispatch, which is exactly what is needed to move an automation part from a warehouse shelf to your plant floor within hours.

For maintenance and automation teams, the practical implication is clear. You will get the best results when your CMMS, ERP, and inventory systems can talk to your key suppliers and logistics partners. That means structured item masters, clean part numbers, integration support from suppliers, and a willingness to treat logistics data as part of your automation landscape rather than a separate world.

The decision comes down to comparing the cost of downtime with the incremental cost of faster shipping and premium services. Case studies from couriers and emergency replacement providers repeatedly show situations where tens of thousands of dollars in lost product or missed orders were avoided through same-day or overnight replacements. If even one avoided incident offsets a yearŌĆÖs worth of premium shipping, the math is straightforward. In my experience, plants that quantify average hourly downtime cost by line find it much easier to justify a hybrid strategy of limited on-site spares plus planned use of same-day services for the rest.

The key is to focus on suppliers who emphasize testing, warranties, and traceability. Industrial Automation Co. stresses multi-point functional testing and roughly two-year warranties for most of its products, and MRO aggregators like ASC Global highlight compliance and component traceability as core features. When evaluating a supplier, ask specific questions about their testing process, request sample test reports, and check references or case studies. Avoid treating price as the only differentiator; in critical automation components, a cheap but poorly tested part is usually the most expensive option in the long run.

For custom parts, the best approach is to adopt identification practices similar to Creative AutomationŌĆÖs custom part ID system. Make sure every custom or modified component in your plant has a unique, clearly visible identifier that maps back to detailed specifications and drawings. For obsolete parts, combine a short-term sourcing strategy with a longer-term migration plan. Use specialist suppliers of obsolete automation components to obtain tested replacements on a same-day or 24ŌĆō48 hour basis when needed, but also track OEM endŌĆæofŌĆælife notices and work with integrators and suppliers to identify retrofit options that can be staged in over time.

Fast, reliable access to automation parts is now as much a part of your control strategy as ladder logic or motion profiles. When you treat same-day delivery as a designed component of your maintenance and logistics architecture, supported by strong suppliers, clear part identification, and warehouse and last mile automation, you move from firefighting to resilience. As someone who has stood on the plant floor watching the clock while a line sat idle, I would much rather invest in that resilience upfront than gamble on the hope that critical components will never fail at the wrong moment.

Leave Your Comment