-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

If you spend your days around PLC racks, HMIs, and conveyor drives, you already know that logistics is no longer someone elseŌĆÖs problem. I have stood on the plant floor at 2:00 AM, watching a packaging line sit idle because a single safety relay failed and the spare in the crib turned out to be the wrong firmware. Production was locked out, operators were waiting, and every minute of downtime was burning money, customer goodwill, and sleep.

In those moments, the difference between ŌĆ£standard shippingŌĆØ and a properly designed fast track delivery program is the difference between losing a shift and losing a customer. Priority shipping for industrial components is not about luxury; it is about protecting throughput, meeting contractual ship dates, and keeping automation assets earning their keep.

This article looks at fast track delivery through a plant engineerŌĆÖs lens. It translates what logistics providers call expedited shipping, final mile, and urgent freight into practical levers you can pull from the control room. The focus is simple: how to use priority shipping intelligently to keep industrial automation running, without letting premium freight costs get out of control.

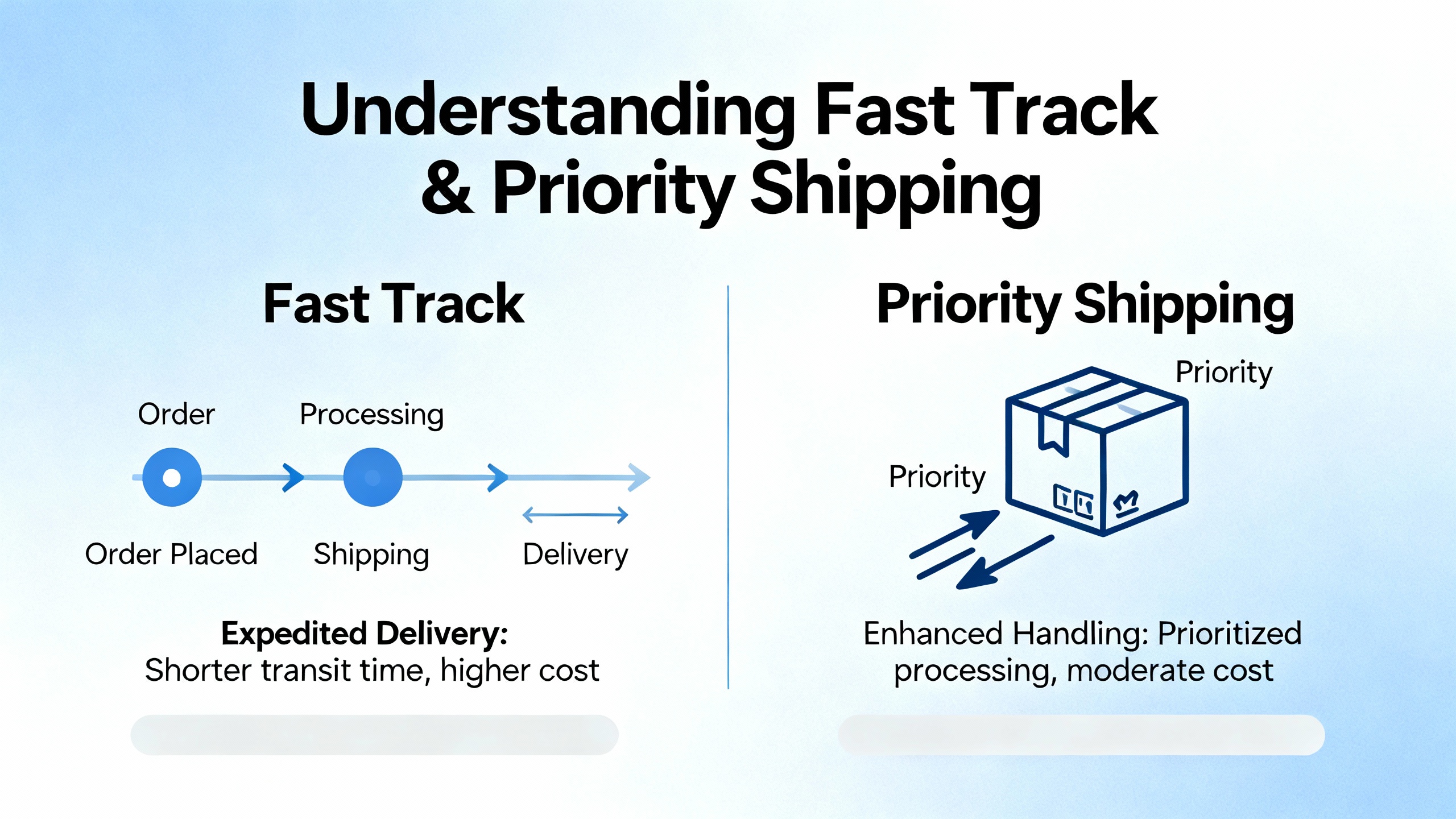

In logistics terms, expedited shipping is a premium service that pushes your shipment to the front of the line. Instead of moving through the usual hub-and-spoke terminals, it travels on dedicated or semi-dedicated capacity with minimal handling and minimal stops.

Providers such as AJC Freight Solutions describe expedited freight as a time-priority option that uses tools like sprinter vans for smaller, local loads and team drivers for long-haul runs. Sprinter vans are ideal when you need a couple of drives, a PLC rack, or a compact panel moved quickly across town; they can get into urban sites and tight yards much more easily than a full tractor-trailer. For runs spanning several states, team drivers take turns behind the wheel so the truck rarely stops, dramatically cutting transit time while staying within hours-of-service rules.

At the more critical end of the spectrum, services like UPS Express Critical bundle modes such as next-flight-out air, chartered aircraft, expedited ground, and even hand-carry options. These are designed for ŌĆ£time equals safety or seven figuresŌĆØ events like aircraft-on-ground situations and urgent medical shipments, but the same model can apply when a major automotive or food plant is down waiting on a specific drive or servo.

The common thread is that priority shipments trade higher freight spend for tighter control of time, handling, and visibility. They are designed to move the right part, to the right dock door, within a very precise window, even if that window is measured in hours rather than days.

For industrial components, the last leg of the journey is often the most fragile. Final mile providers like USPack Final Mile focus on getting heavy, oversized, or high-value parts from a regional hub to your dock or job site with precision. They support just-in-time deliveries, scheduled replenishment, and on-demand emergency runs. Some report on-time performance around 98% and can work to delivery windows as tight as fifteen minutes, which is exactly what tight construction and commissioning schedules need.

Same-day and hot-shot services, described by providers such as Curri, Roadie, and Speedy Freight, operate almost like an extension of your own fleet. You book a run from your distributor or fabrication shop to the plant, and within minutes a vehicle is dispatched to handle anything from a single box to several thousand pounds of equipment. Operations teams use these services not only for emergencies but also for daily recurring routes that feed production lines and satellite warehouses.

When you combine these fast modes with real-time tracking and proof-of-delivery tools, you have the raw ingredients for a fast track delivery program that you can rely on from the maintenance office, not just from the logistics department.

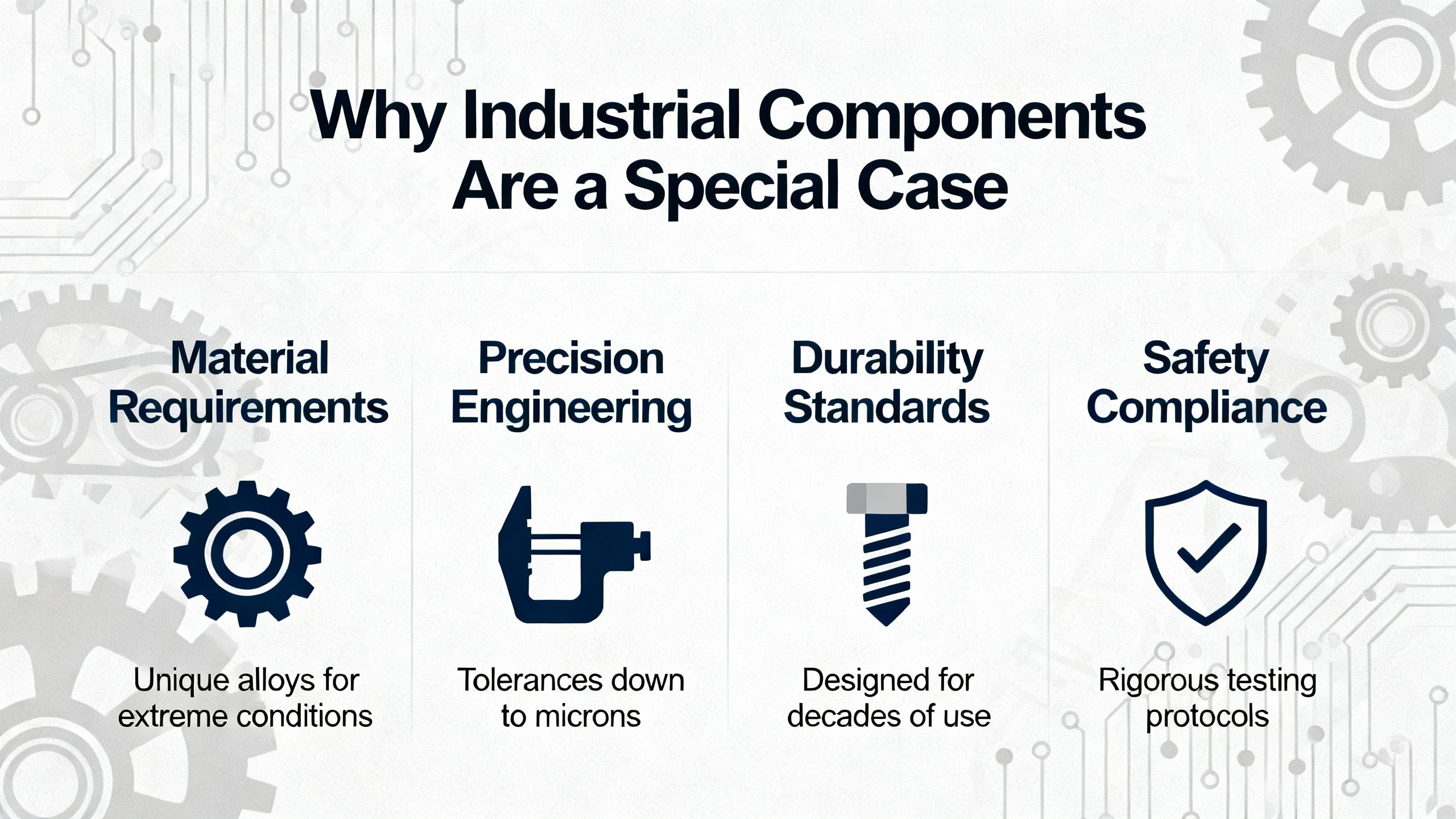

Priority shipping of parts for industrial automation is not the same as rushing a consumer package. The risk profile, handling requirements, and site constraints are very different.

Heavy gearboxes, palletized control panels, or a crate of servo motors behave very differently in transit than a carton of sneakers. Articles on industrial logistics from providers like USPack highlight the need for forklift-compatible handling, liftgate services for job sites without docks, and white-glove options for delicate, high-value instruments. Delivery teams must understand how to maneuver in active construction zones and manufacturing sites, where the wrong turn can put a truck in a restricted area or block a critical aisle.

Chain-of-custody is also more important. Industrial shipments may be worth hundreds of thousands of dollars and can be safety-critical in sectors such as energy or aerospace. That is why leading final mile providers use barcode scanning, milestone tracking, secure handoff protocols, and electronic proof of delivery with time-stamped signatures and geolocation data. From an automation engineerŌĆÖs perspective, this level of traceability means you can answer exactly where that replacement drive or safety PLC is, who signed for it, and whether it actually made it to the correct dock.

Finally, industrial sites bring their own operating rules. Drivers must follow PPE requirements, lockout/tagout boundaries, and sometimes escorted access. Partners like Speedy Freight emphasize trained drivers who understand booking-in procedures, out-of-hours collections, and handling fragile, high-value technical equipment. If you have ever had a driver turned away at the gate for missing a safety briefing, you know that site procedures can easily erase the time you thought you were saving with expedited transport.

Not every shipment deserves the premium of fast track delivery. The art is knowing when priority shipping changes the outcome and when it simply pads cost. Several common scenarios consistently justify a faster mode.

The clearest case is a line-down event with no suitable spare on site. Expedited freight specialists such as RJ Logistics and Entourage Freight Solutions frame their services around unexpected disruptions: severe weather, parts shortages, and sudden stockouts. In industrial environments, the equivalent is a failed VFD, controller, or custom sensor that stops production.

In these moments, the cost of downtime can quickly overshadow freight costs. While exact numbers vary by industry, it is common for production stoppages in high-throughput plants to be valued at thousands of dollars per hour. A same-day or overnight shipment for a critical part is often the cheapest component of the fix, provided you trigger it early, communicate clearly, and have the right logistics partner on call.

Many plants have shifted toward just-in-time replenishment and lean inventory to avoid tying up working capital in stockrooms. Network-focused logistics research referenced by McKinsey shows that data-driven inventory strategies can improve service levels by up to 30% while lowering costs by 10ŌĆō20%. The trade-off is that stockouts hurt more when there is little buffer.

Expedited logistics, as described by Shippei and Speedy Freight, act as a safety valve for JIT systems. Fast delivery of raw materials, components, and replacement parts allows you to run with leaner on-site inventory and still respond to demand spikes or last-minute engineering changes. In some sectors, such as healthcare and pharmaceuticals, final mile providers are treated as essential infrastructure because delayed deliveries directly affect patient care. The same logic applies when a missed shipment threatens an automotive OEMŌĆÖs build schedule or a food plantŌĆÖs seasonal promotion.

Harvard Business Review has reported that stockouts can drive up to 43% of customers to defect when no substitute is available. In industrial automation, the ŌĆ£customerŌĆØ may be an internal plant or an external OEM client. Either way, missing delivery windows due to a slow-moving component can carry relationship damage far beyond the cost of freight.

For large, fragile, or expensive automation assets, such as custom control cabinets, robotic cells, or precision measurement equipment, the risk is not only delay; it is damage or loss. USPack and other industrial-focused carriers describe specialized handling that includes white-glove delivery, secure strapping and load control, and personnel trained in compliance and safe handling. When a shipment contains something that took months to engineer and assemble, priority shipping with elevated chain-of-custody and handling standards is often the most conservative choice.

If you work on greenfield plants or major retrofits, you know that schedules are held together by a web of dependencies. Final mile partners with multiple cross-dock facilities, thousands of vetted drivers, and twenty-four-seven operations support, as highlighted in USPackŌĆÖs materials, can absorb schedule swings and site-access constraints far better than ad hoc transport. They can support scheduled deliveries of HVAC units, electrical enclosures, and machinery skids, along with on-demand runs when a missing bracket or I/O card threatens a crucial milestone.

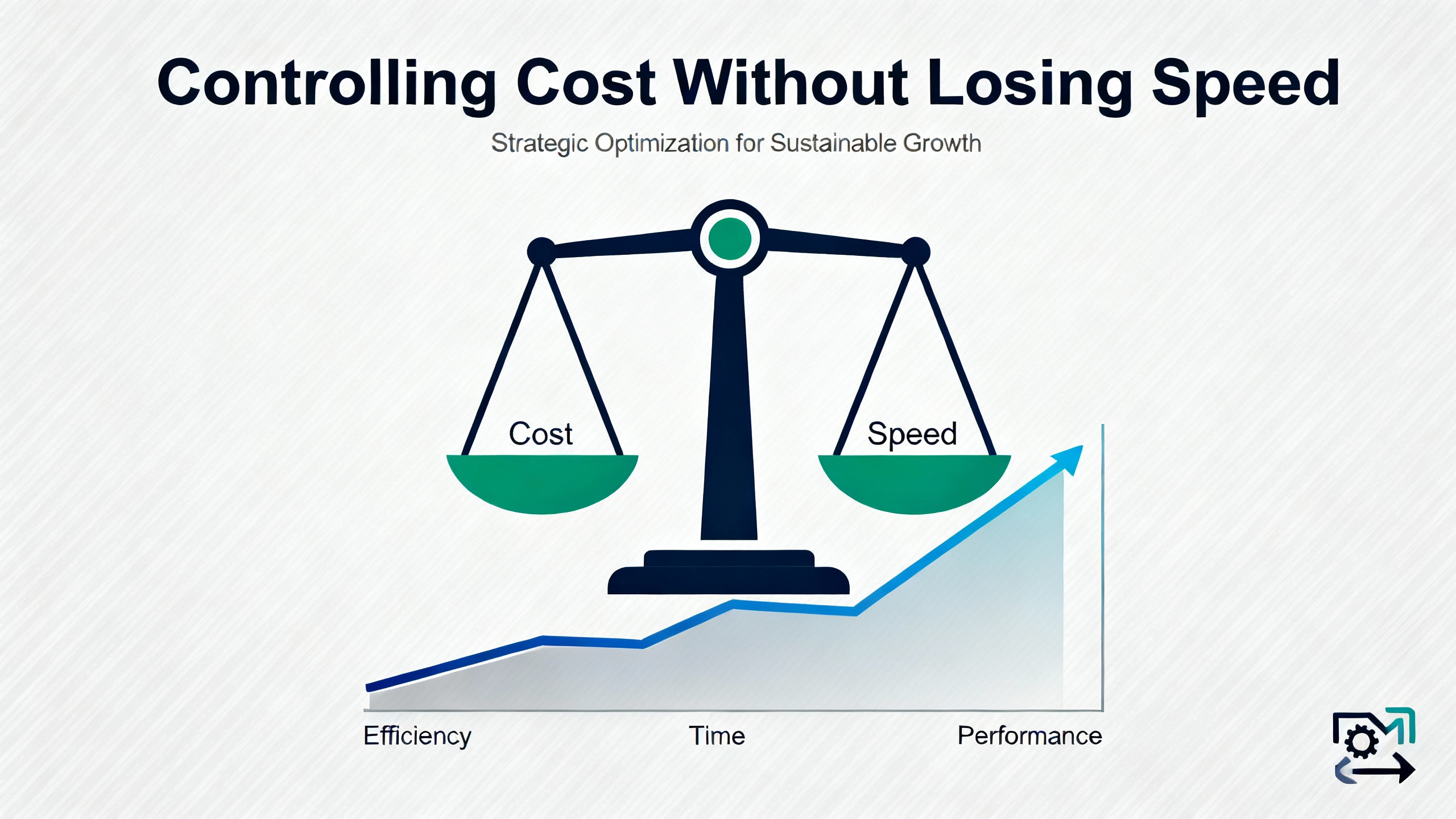

Fast track delivery is a powerful tool, but like any powerful tool, it has trade-offs. It is best understood as one element of supply chain design rather than a panic button you hit when everything else fails.

A concise way to view the balance is through the following comparison.

| Aspect | Benefits of Priority Shipping | Trade-offs and Risks |

|---|---|---|

| Delivery speed | Same-day or next-day arrival reduces outage time and keeps projects on schedule. | Premium rates can be several times higher than standard shipping, especially for air or dedicated truck. |

| Downtime avoidance | Faster parts delivery can prevent expensive line stoppages and missed customer ship dates. | Overusing expedite for non-critical loads normalizes high freight spend without proportional benefit. |

| Inventory strategy | Supports lean, just-in-time stocking by acting as a safety valve when demand spikes. | Depending too heavily on expedited options can mask chronic forecasting and planning weaknesses. |

| Visibility and control | Real-time tracking, chain-of-custody, and ePOD provide ground truth for critical shipments. | More complex coordination is required across maintenance, purchasing, and logistics to use these tools well. |

| Cash and budgeting | Strategic use can protect revenue and contracts, outweighing freight premiums. | Poor governance can lead to paying, as one Inbound Logistics example notes, more in expedite cost than the revenue at risk. |

The central message is that priority shipping delivers reliability and speed, but only pays off when applied to the right shipments with clear decision rules.

From the automation side of the fence, you cannot control every logistics lever, but you can design how your plant or integration business uses fast track delivery. Instead of waiting for the next emergency, build a simple playbook.

Start by defining what ŌĆ£criticalŌĆØ means in your environment. A sensible approach, echoed by guidance from Inbound Logistics and Entourage Freight Solutions, is to evaluate not just the partŌĆÖs cost, but the operational and financial impact of delay. A part deserves priority shipping if delay would stop production, violate a firm customer delivery commitment, jeopardize safety, or threaten regulatory compliance.

Conversely, components for non-urgent maintenance, non-critical spares, or projects without fixed go-live dates rarely warrant air freight or a dedicated truck. Shippers who reflexively select the fastest option quickly discover that they are paying premium rates to protect relatively modest revenue. Inbound Logistics shares an example where paying eight thousand dollars to protect five thousand dollars of sales clearly made no sense once the math was transparent.

Once you have clear criticality categories, match them to service levels. For example, you might reserve same-day local van service for true line-down emergencies and overnight ground for high-priority but non-catastrophic orders. Next-flight-out air or chartered options fit a much smaller set of situations where the total impact of delay is high enough to justify the spend.

Several best practice sources emphasize that you should avoid vague directions like ŌĆ£as soon as possible.ŌĆØ Instead, share realistic delivery deadlines and allow your logistics partner to propose multiple options. Sometimes shifting a pickup window from midnight to early morning can cut expedited cost dramatically while still meeting your operational need.

A powerful tactic highlighted in the expedited shipping guidance from Inbound Logistics is to expedite only the portion of the shipment that is truly time-critical. If only one pallet of specialized sensors is holding up a line, send that pallet via a fast mode and move the remaining five pallets by standard LTL. This approach aligns freight spend with risk rather than treating every carton as equally urgent.

The worst time to evaluate a logistics provider is while your main packaging line is down. Articles from RJ Logistics, USPack, and others consistently stress the value of developing expedited strategies in advance, with providers who offer twenty-four-seven support, proven on-time performance, robust safety and compliance practices, and integrated technology.

Look for partners with dense networks and varied equipment, from sprinter vans to box trucks with liftgates and full truckload capacity. Some industrial-focused providers maintain cross-dock facilities across regions and can deploy thousands of vetted drivers, enabling them to flex with seasonal demand and project surges. Others, like UPS Express Critical, bring access to air and charter modes when you truly have no slack.

The goal, from an automation engineerŌĆÖs standpoint, is to know exactly whom to call, which account to reference, and what service level to request the moment a line-down ticket is opened.

Packaging and paperwork are often the quiet bottlenecks in fast track delivery. Manufacturing-focused guidance from carriers and third-party logistics providers emphasizes using new, high-quality materials, minimizing empty space, and securing loose components with pallet wrap or custom crates. For fully assembled machinery or fragile panels, a crate designed to absorb shock and protect protruding components will reduce transit damage dramatically.

Correct freight classification also matters. Manufacturing shipping experts note that freight classes and NMFC codes for machinery can span a wide range, and misclassification on the bill of lading can trigger inspections, additional fees, and delays. Even if you do not own the classification, you can insist that your suppliers verify their codes and keep them updated when designs or packaging change.

Documentation needs the same discipline. RJ Logistics and Entourage Freight Solutions both stress that accurate, complete paperwork is critical for expedited loads, because any error at a checkpoint, terminal, or border crossing consumes the very time you paid to save. Bills of lading, customs forms, and special handling instructions should be standardized and prepared in advance where possible, not assembled at the dock door under time pressure.

Automation can help here as well. Entourage Freight Solutions describes automatic truck loading systems that can cut loading and unloading times from thirty minutes or more down to just a few minutes. For plants moving frequent high-priority loads, investment in this type of material handling can be as important as the choice of carrier.

Effective fast track programs depend on seeing what is happening in real time. Research summarized by Jusda Global indicates that end-to-end, real-time tracking can improve on-time delivery performance by up to sixty percent and significantly strengthen customer trust. When logistics platforms combine GPS, RFID, IoT sensors, and mobile proof-of-delivery, operations teams have the visibility they need to make decisions while shipments are in motion.

Technology-focused sources like NetworkOn and DispatchTrack show how route optimization and AI-driven analytics link together transportation management, warehouse data, and order flows. Machine learning models can cut forecasting errors by up to half and reduce warehousing costs by 10ŌĆō40%, according to McKinsey, by ensuring the right inventory is in the right place before you ever need to expedite. On the road, advanced routing and telematics have helped companies like DHL cut delivery times by about fifteen percent while also reducing fuel consumption.

For industrial automation teams, the practical takeaway is that priority shipping should integrate with your existing systems. Ideally, your maintenance management or ERP system can surface tracking links, expected delivery times, and exceptions without forcing you to log into separate portals or chase emails.

Expedited shipments are rich with lessons. Providers such as Entourage Freight Solutions and Inbound Logistics argue that continuous improvement in expedited logistics comes from systematically collecting customer and internal feedback, tracking performance metrics, and using those insights to refine processes.

From the plant side, that means logging why each priority shipment was needed, how long the outage or risk window actually was, whether spares policies or project planning contributed, and how well the logistics partner performed. Over time, you can identify patterns, adjust reorder points, redesign bills of materials, or renegotiate service levels so that you rely on premium freight only when it truly protects value.

Finance teams are rightfully skeptical of runaway expedited freight costs. The good news is that the very practices that improve reliability often reduce cost as well.

Several pragmatic strategies appear across the expedited shipping guidance from Inbound Logistics, RJ Logistics, and DATŌĆÖs general industry notes. The first is to ask clear questions before authorizing fast track: what is the real business consequence if this shipment arrives by the standard date instead of the earliest possible date, and are there intermediate service options that meet the need at lower cost?

Next, broaden the conversation from freight rates to total cost. Inventory carrying costs, production stoppages, out-of-stock events at customers, and downstream penalties or lost revenue frequently dwarf rate differences between modes. In some cases, paying for a door-to-door air move is cheaper than carrying large safety stocks or risking a contractual penalty.

Another practical tactic is to invite providers to quote multiple service levels and transit times. Giving a specific required delivery date and time, instead of simply asking for the fastest route, allows them to consolidate loads and optimize trailer space. Many shippers have discovered that making delivery windows slightly wider still keeps customers happy while cutting expedite surcharges.

A final lever is to treat expedited shipping as a planned capability rather than a sign of failure. Inbound Logistics emphasizes that building expedited options into supply chain design, and reserving them for critical components only, turns what used to be a last-minute scramble into a routine, governed process. That mindset shift alone makes it far easier to control both frequency and cost.

Industrial automation and logistics automation are converging. The same technologies you deploy inside the plant are transforming how fast track shipments move outside it.

In warehouses and cross-dock facilities, research cited by the Warehousing Education and Research Council shows that picking and travel can account for nearly 55% of total labor cost. Layout optimization and slotting can improve picking rates by more than 40%. Automation adds another layer: fulfillment centers using advanced automation have seen order processing speeds increase by 25ŌĆō45%, with error rates dropping below 0.1% compared to 1ŌĆō3% for manual operations. Robotics vendors report productivity gains of over 200% after deploying collaborative autonomous mobile robots in some environments.

Jusda Global reports that warehouse robotics can increase order processing speed by up to 70%, triple work capacity, and cut delivery preparation time by about 35%. Those gains translate directly into the ability to cut cutoff times later in the day while still shipping components on the same truck or plane.

On the planning side, AI and predictive analytics increasingly drive forecasting and risk management. McKinseyŌĆÖs research on AI in supply chains notes that AI-powered forecasting can reduce errors by up to half and significantly lower warehousing costs. Inbound Logistics highlights how AI agents and automation can shift organizations from reactive ŌĆ£war roomŌĆØ responses to proactive coordination, monitoring shipments around the clock, flagging issues early, and initiating mitigation plans before customers feel the impact.

From an industrial automation engineerŌĆÖs perspective, this means your expectation of what ŌĆ£fast but reliableŌĆØ shipping looks like should evolve. It is reasonable to expect accurate ETAs, proactive delay alerts, and clear chain-of-custody information for critical shipments. When logistics partners lack these capabilities, your ability to manage downtime and commissioning risk is weakened, no matter how well your PLC code is written.

Fast track delivery matters not only in day-to-day maintenance, but across the entire lifecycle of automation projects.

During design and procurement, understanding lead times and logistics capabilities helps you decide which components must be ordered early and which can be sourced closer to installation. For long-lead items like custom panels or large servo systems, it may still be wise to build schedule float rather than relying on urgent freight. For standardized items that multiple distributors stock, pre-negotiated overnight or two-day priority options can keep projects flexible, especially when design changes happen late.

When you enter commissioning, a clear playbook for priority shipping becomes critical. If you discover during I/O checkout that a field signal conditioner was specŌĆÖd incorrectly, you should already know which distributor can ship the replacement that afternoon, what service level to request, and how to route the truck onto site without violating safety rules. That is the moment where a same-day industrial delivery partner, positioned as an ongoing logistics ally rather than a one-time courier, earns their keep.

In steady-state operations, combining a sensible critical spares strategy with fast track delivery gives you resilience without bloated inventory. Some plants choose to keep a minimal set of truly critical spares on site while relying on partners like USPack, Speedy Freight, or regionally focused carriers to supply less-critical items quickly when needed. With accurate inventory, forecasting, and condition-monitoring data feeding into logistics plans, this hybrid approach can protect uptime and cash at the same time.

The choice between expedited ground and air usually comes down to distance, time window, and the real cost of delay. Many industrial-focused providers now offer team-driver ground services that can cover long distances surprisingly fast, often at far lower cost than next-flight-out air. If your delivery window is measured in one or two days and the route is within a reasonable driving radius, expedited ground is often sufficient. Air or chartered options tend to make sense only when every hour of delay carries very high operational or contractual risk, such as line-down situations in plants where output is extremely valuable or where missing a customer window triggers significant penalties.

There is no universal answer, but research synthesized by McKinsey and others suggests that optimized, data-driven inventory strategies can raise service levels and lower costs at the same time. For very low-cost, high-criticality items, keeping spares on site is usually smart. For high-cost or rarely used items, combining a smaller local inventory with reliable priority shipping from regional warehouses or distributors often provides a better balance. The key is to use real data about failure modes, lead times, and downtime cost, and to ensure your logistics partners can actually deliver the promised service levels when you need them.

Before you ever pick up the phone, align internally on what counts as critical, which service tiers map to which scenarios, and who is authorized to approve premium freight. Work with your logistics partners to set up accounts, clarify site access rules, and test data flows for tracking and proof-of-delivery. On the technical side, make sure your bills of material, spare parts lists, and maintenance records clearly identify which components are eligible for fast track and where they are sourced. The more of this groundwork you do before the first line-down call, the more your priority shipping program will feel like a routine workflow instead of a fire drill.

Fast track delivery of industrial components is not magic; it is the result of clear priorities, solid partners, and disciplined use of data. When you treat priority shipping as an engineered part of your automation strategy, rather than a last-minute panic purchase, you gain the ability to protect uptime, support lean inventory, and keep customers confident that your lines will deliver. As someone who has watched production crews waiting on a single crate, I would rather have a tested fast track playbook in my back pocket than rely on luck and standard transit times when the alarms start flashing.

Leave Your Comment