-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

When you are responsible for keeping a plantŌĆÖs PLCs, HMIs, drives, and safety systems running, you stop thinking about ŌĆ£procurementŌĆØ as a back-office function. It is the difference between a line humming at full rate and a night of explaining to operations why a $300 input card just cost the company tens of thousands of dollars in lost output.

From that plant-floor perspective, the question is not whether to buy direct from the OEM or through an independent distributor. The real question is when each channel makes sense, and how to combine them so you get both control and resilience.

Based on the research from independent distributors, industry publications, and supply chain experts, plus what I see on real factory projects, independent distributors deserve a deliberate, planned spot alongside OEM and authorized channelsŌĆönot as a shady last resort, but as a strategic tool.

In industrial automation, ŌĆ£OEM channelŌĆØ usually means buying components directly from the manufacturer or through franchised or authorized distributors who have formal agreements with that manufacturer. These channels are set up to protect traceability, warranty, and consistent branding. If you are buying new PLC platforms, networking infrastructure, or drives for a greenfield project, OEM and authorized distributors are often your first stop.

Independent distributors, sometimes called open-market or nonŌĆæfranchised distributors, are different. As described by sources such as J2 Sourcing, Microchip USA, Rand Technology, and others, they are not tied to a single manufacturerŌĆÖs contracts or territories. They build large global networks across OEMs, contract manufacturers, and other distributors. That freedom means they can source from multiple geographies, tap surplus and excess stock, and track down obsolete or hard-to-find components that have disappeared from the OEMŌĆÖs price list.

Hybrid distributors combine both worlds. Companies like Sensible Micro carry authorized lines where they are franchised, but also operate in the independent channel. In practice, a hybrid distributor might supply certain motion or safety products directly from OEM agreements while at the same time sourcing an obsolete microcontroller or legacy I/O card from the open market.

A simple way to think about the difference is that OEM and authorized channels are optimized for planned demand, traceability, and long-term platform strategy, while independent and hybrid distributors are optimized for flexibility, speed, and exceptions.

The two families of channels are not interchangeable; they solve different problems.

| Aspect | OEM / Authorized Channels | Independent / Open-Market / Hybrid Distributors |

|---|---|---|

| Commercial relationship | Structured contracts, fixed pricing rules, rebate schemes | Opportunistic and flexible deals, more room to negotiate based on market conditions |

| Sourcing scope | Mostly current and supported catalog parts | Current, constrained, obsolete, and surplus parts from many sources |

| Lead times | Strong on forecasted, planned demand, but constrained in global shortages | Designed to react quickly to shortages, changes, and emergencies |

| Traceability and warranty | Direct traceability to manufacturer, formal warranty support | Varies by distributor; top players invest heavily in QMS, testing, and documentation |

| Service model | Strong design-in and application engineering on OEM portfolios | Strong on supply-chain problem solving, alternates, and BoM-level support |

| Typical use | New projects, standardization, long-term platform roadmaps | Line-down recovery, obsolescence, spot buys, last-time buys, cross-references |

McKinsey & CompanyŌĆÖs work on industrial channels shows why OEMs are pushing direct and digital sales harder. When OEMs sell more directly, they capture more margin and get cleaner visibility into end-customer demand and pricing. Case studies they cite include an industrial automation player that raised direct sales from 5% to 20% and gained market share in just six months, and a semiconductor OEM that reversed a multi-year revenue decline by increasing direct sales from 40% to 70%.

None of that eliminates the need for independent distribution. It simply means OEMs will keep optimizing their own channels, and you need to optimize your side of the equation by adding the right independent partners rather than relying on a single route to every part.

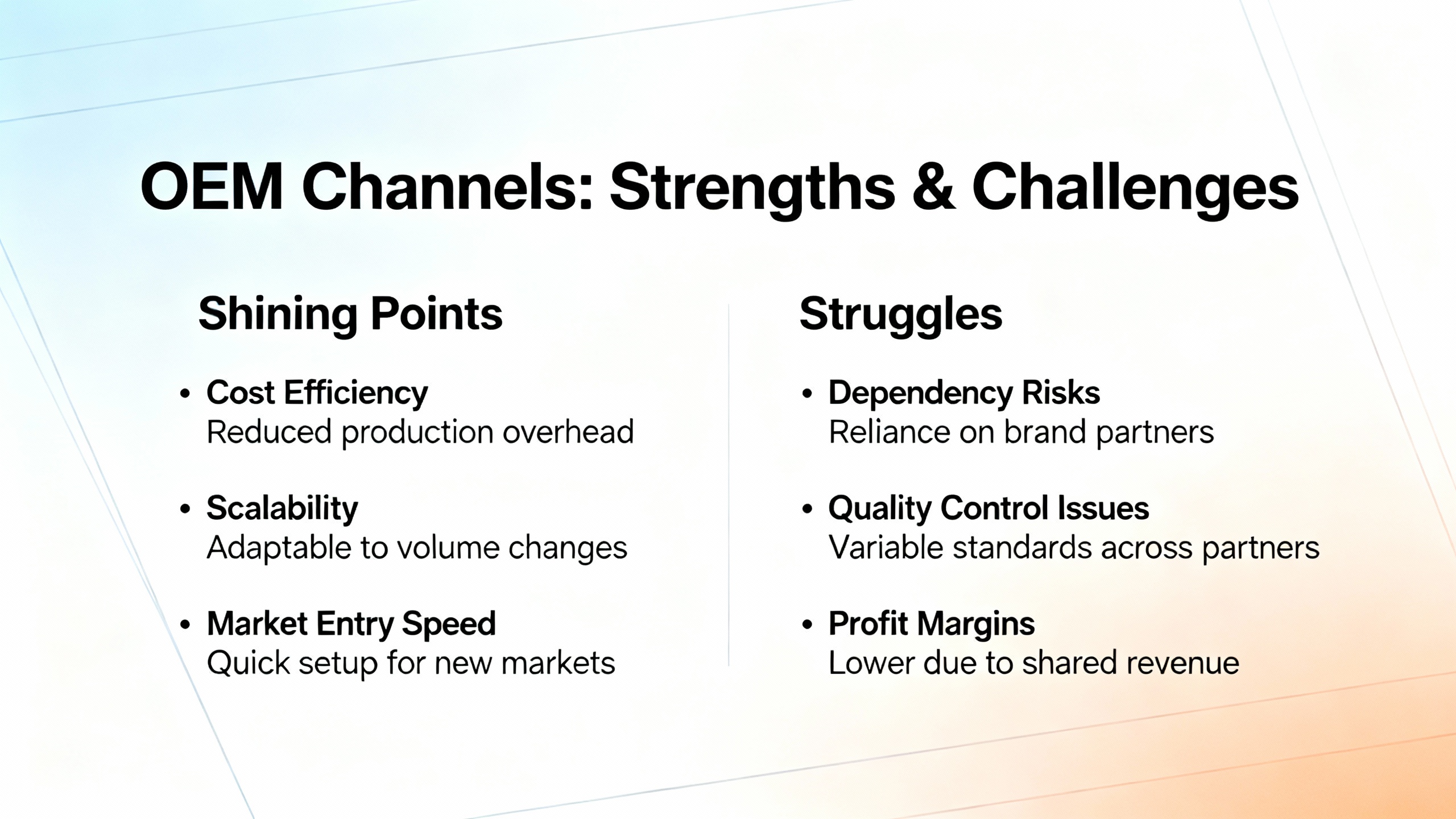

From an automation engineerŌĆÖs standpoint, OEM and franchised distributors are invaluable when you are standardizing on a platform or deploying a new architecture. You get official firmware, life-cycle roadmaps, and clear visibility into what is supported. You also get formal warranty coverage and clean traceability, which matters deeply in regulated sectors such as medical and aerospace manufacturing.

However, the same structures that make OEM channels controlled and predictable also make them rigid. When supply is tight, authorized distributors are bound by allocation rules and contracts that limit how much they can bend. Modern Pumping Today describes how industrial control equipment OEMs face chronic shortages and extended lead times even for relatively low-cost components such as multilayer ceramic capacitors. In those situations, the official channel may simply tell you to accept a long lead time because their own allocation is constrained.

Another limitation is obsolescence. In long-lifecycle environments such as process plants, power generation, or pharmaceutical production, a control system can run for decades. A McKinsey analysis notes that OEMs increasingly prioritize direct, digital channels and new product introductions. They cannot economically stock every niche legacy part forever. Once a PLC or HMI family goes end-of-life, OEMs typically push you toward platform migration rather than the small quantities of spare CPUs or communication modules your installed base might still need.

For routine projects, these trade-offs are acceptable. For a line that is down or a safety system that must be kept running until a planned shutdown window, they are not.

Across multiple sources, a consistent theme is that independent distributors win on speed and responsiveness. Rand Technology highlights agility and the ability to source rapidly from a broad global network when supply chains are disrupted. Ezkey, another independent player, describes service-level targets such as responding to a customer request in about two hours and getting material deployed globally in as little as seventy-two hours once a deal is agreed.

From a controls engineerŌĆÖs viewpoint, this is the difference between having an entire bottling line waiting three months for a particular motion drive card and getting the card shipped in time for a weekend maintenance window. On real projects, I have seen independent distributors pull replacement PLC CPUs from excess stock on another continent while the authorized channel was still talking in terms of quarter-long lead times.

Behind that speed sits a very deliberate strategy. Modern Pumping Today describes how well-run independents anticipate shortages and execute long-term buys on critical components, locking in lower prices and availability before markets tighten. For large OEM orders, those distributors can lock in prices and delivery dates months in advance and even provide financing for customers with capital constraints. In practical terms, that means they can put material on the shelf in anticipation of your demand instead of waiting for the OEM allocation cascade to finish.

If you maintain legacy PLC platforms, proprietary servo drives, or older intrinsic-safety barriers, you already know that obsolescence is not just an IT problem. One missing microcontroller or ASIC often means redesigning a whole board or swapping an entire control family.

Independent distributors specialize in exactly this gap. J2 Sourcing, for example, shares a case where they located an obsolete microcontroller for a medical device manufacturer and avoided a costly redesign and delay. Semiconductor Review emphasizes that independent distributors are particularly strong on end-of-life and obsolete components, using global networks and secondary markets to secure parts that authorized distributors simply cannot provide.

Microchip USA and other open-market distributors echo the same point: because they are not locked into a single portfolio, they can search excess inventories, secondary markets, and regional surpluses. For industrial automation, that often translates into finding the exact safety I/O card or HMI CPU you need to keep a validated process running until you can plan a controlled migration.

Modern supply chain thinking emphasizes flexibility and multi-sourcing as core levers. Procurement and supply chain management experts note that flexibility does add cost if you simply duplicate suppliers, but a smart design balances total cost against risk. Independent distributors are one of the cleanest ways to add flexibility without redesigning your product.

Microchip USA argues that open-market distributors strengthen resilience by providing alternative sourcing paths when franchised channels face shortages or long lead times. Smith, a major independent distributor, describes how its network relationships and global market visibility let it match customers with surplus in one region to buyers facing shortages in another, essentially acting as a balancing valve across the market.

From a plantŌĆÖs standpoint, this is multiŌĆæsourcing without exploding your approved vendor list. You keep OEM and franchised channels as your default, but you intentionally qualify a small number of independent or hybrid distributors to handle exceptions: allocation, regional shocks, logistics constraints, or sudden customer pull-ins.

Independent distributors are not always cheaper than OEM channels for every part, but the research suggests they can often secure competitive pricing, especially in specific situations.

J2 Sourcing reports an automotive electronics firm that reduced project costs by buying through them instead of franchised distributors by tapping surplus stock and flexible pricing. Rand Technology points to cost efficiency derived from services such as excess inventory management and just-in-time delivery, which reduce carrying costs and waste. Microchip USA notes that open-market distributors often find attractive pricing on obsolete, slow-moving, or excess stock that OEMs and franchised distributors price at a premium or no longer carry at all.

In industrial automation, this plays out when you are buying niche communication cards, specialty sensors, or older drive firmware. If the OEM treats those as ŌĆ£non-strategic remnants,ŌĆØ their volume-based pricing structure may be unfavorable. A good independent distributor can use surplus, secondary stock, or regional price differences to improve your total landed cost while still meeting your technical and quality requirements.

Modern distribution is as much about information as it is about inventory. Smith emphasizes that its openŌĆæmarket transaction data provides deep insight into buying and selling trends and that this data is used to help customers build personalized supply chain strategies, identify price or demand inefficiencies, and optimize planning.

Ezkey uses an intelligent billŌĆæofŌĆæmaterials matching system to accelerate material matching and reduce procurement time and cost, providing early warnings on inventory risk. Fusion Worldwide stresses the importance of global market intelligence and timely delivery of insights via calls, meetings, or email to make or break transactions in tight conditions.

For an automation team, this kind of intelligence is practical. If you know that a certain memory chip used in your industrial PC platform is trending toward allocation, you can plan lastŌĆætime buys and redesign efforts ahead of the next retrofit program instead of finding out only when your usual distributor suddenly stretches lead times.

The old stereotype of an independent ŌĆ£brokerŌĆØ was a middleman who bought wherever possible, resold with a markup, and shouldered little responsibility for quality. The modern independent distributors described in sources such as Rand Technology, Modern Pumping Today, Fusion Worldwide, and Ezkey are very different.

Rand Technology calls its quality system a Global Integrated Quality Management System and holds AS6081 certification for counterfeit mitigation testing. They describe a seventy-twoŌĆæpoint inspection process as part of their value-added services. Classic Components, profiled in Modern Pumping Today, provides full chain-of-custody documentation where available and, when traceability is incomplete, deploys visual, electrical, and physical testing as part of a risk mitigation plan.

Hybrid distributors like Sensible Micro combine testing and inspection with engineering work. They talk about performing lifecycle analysis to avoid last-time-buy mistakes, verifying authenticity via in-house visual inspection on every order, on-demand electrical testing, and XŌĆæray analysis. They also offer to cross hard-to-source parts to authorized alternatives and help monetize aging inventory.

In an automation context, these capabilities translate into fewer surprises when parts hit your goods-in dock and fewer nasty root-cause investigations when a machine fails in the field.

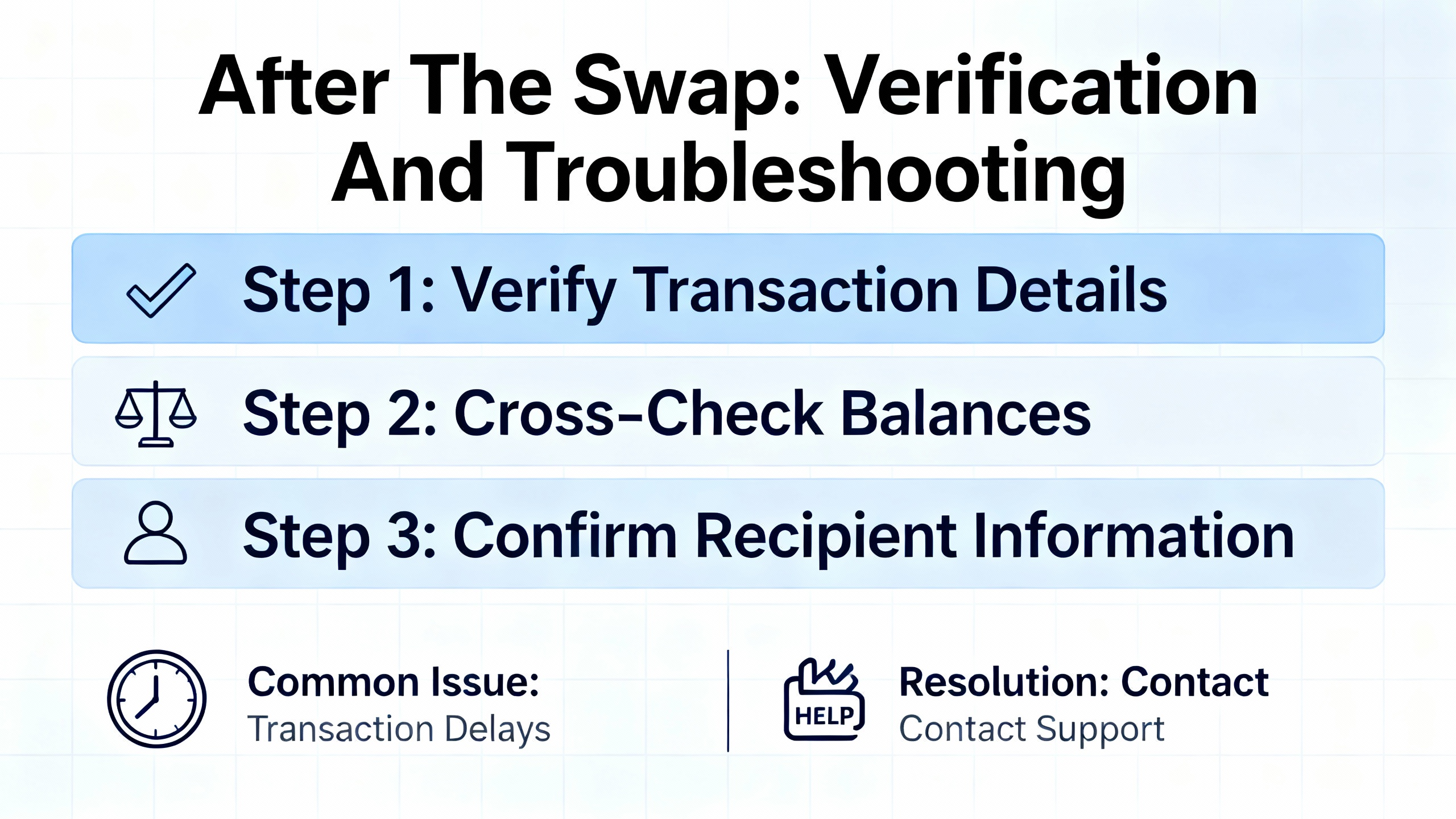

Using independent distributors does introduce real risks if you treat the open market as a free-for-all. Industry guidance on sourcing components from the open market highlights counterfeit or remarked parts, reclaimed parts sold as new, poor storage history, and incomplete or falsified traceability as the main hazards.

The best practice coming out of sources such as Modern Pumping Today, Microchip USA, Ezkey, and industry counterfeit-avoidance experts is clear. You start by rigorously vetting the distributor itself. Look for ISO 9001 or equivalent quality management certification and, for aerospace or high-reliability work, certifications such as AS9120 or AS6081. Check membership in recognized industry associations and ask for references from other OEM or EMS customers.

Next, examine their quality system. Leading independents invest in supplier management, rating and preferred-supplier programs, and advanced inspection equipment. Modern Pumping Today summarizes the principle as ŌĆ£know your source,ŌĆØ which means understanding not only the immediate supplier but also the chain of intermediaries, how the parts were stored, and whether the claimed availability is actually credible given market demand.

Inspection is another pillar. Robust flows include external visual inspection, dimensional checks, XŌĆæray, XRF or material analysis, decapsulation and die inspection for high-risk parts, and functional or parametric electrical testing depending on how critical the component is. EzkeyŌĆÖs model of combining internal inspection centers in Shenzhen and Hong Kong with partnerships to thirdŌĆæparty labs like White Horse Laboratory illustrates how independents can combine internal and external testing to both improve quality and reduce cost and turnaround.

Finally, documentation and traceability matter. Classic Components is described as providing chain-of-custody records showing all intermediaries when possible. If traceability is incomplete, the distributor should present a clear riskŌĆæmitigation plan and test results, not just a shipment.

In industrial automation, you integrate this into your own quality process. Treat independent distributors as approved vendors with their own control plans, incoming inspection plans, and escalation paths, especially for safety-related components, control CPUs, and anything used in regulated industries.

Many plants still rely on installed bases of older PLC families and panel-based HMIs that are technically obsolete but operationally vital. Upgrading to a new platform is sometimes the right move, but often the timing is dictated by qualification windows, customer approvals, or capital budgets, not just by the OEMŌĆÖs life-cycle bulletin.

Independent distributors shine here. The combination of global networks, access to secondary markets, and focus on obsolete parts that Semiconductor Review and J2 Sourcing describe is exactly what you need when a legacy controller fails. You specify your firmware revision and hardware series, and a good independent distributor will either locate the exact match or propose a compatible alternative, backed by test results and return terms that fit within your risk appetite.

When a bottling line, press line, or packaging cell goes down because of a failed servo amplifier, bus coupler, or I/O rack, the time dimension dominates every other consideration. In those moments, OEM channels often fall back on standard lead times and allocation policies. Independent distributors, by contrast, are built for ŌĆ£find the part nowŌĆØ behavior.

EzkeyŌĆÖs response and deployment times and Rand TechnologyŌĆÖs emphasis on agility are not abstract marketing claims; they reflect a structural difference. These companies maintain large global inventories, relationships across many regions, and the authority to buy opportunistically. Combined with good quality controls, that agility is what gets your VFD board on a plane tonight instead of into a production slot next quarter.

Shortages in categories such as MLCCs have made it obvious that treating every buy as spot procurement is dangerous. Modern Pumping Today notes that independent stocking distributors often anticipate shortages and execute long-term buying strategies, including speculative buys, to secure critical components ahead of tightening.

In industrial automation, that strategic behavior can be directed toward the component level (for example, a microcontroller that will disappear from a drive controller board) or the assembly level (for example, a specific PLC I/O card that you know is approaching end of life). Hybrid distributors like Sensible Micro extend this with lifecycle analysis and advice on when to execute lastŌĆætime buys and how much to purchase, so you do not end up with warehouses full of stranded stock.

The result is a more deliberate approach to inventory: OEM channels provide roadmap visibility; independent distributors translate that into concrete stocking plans, locked-in pricing, and, in some cases, financing.

Just as shortages hurt, excess inventory quietly erodes your P&L. Smith describes distribution as the business of matching surplus in one place with shortages in another and emphasizes balanced supply as a core capability. Hybrid distributors such as Sensible Micro go further and help monetize aging inventory through buyback or resale programs.

For an automation OEM or large end user, this means you can clear obsolete boards, overŌĆæpurchased components, or misconfigured drives from your shelves and turn them into working capital. The same distributors that source your hard-to-find parts can often place your excess into markets where those parts are still in demand, reducing environmental waste and helping other manufacturers avoid line downtime.

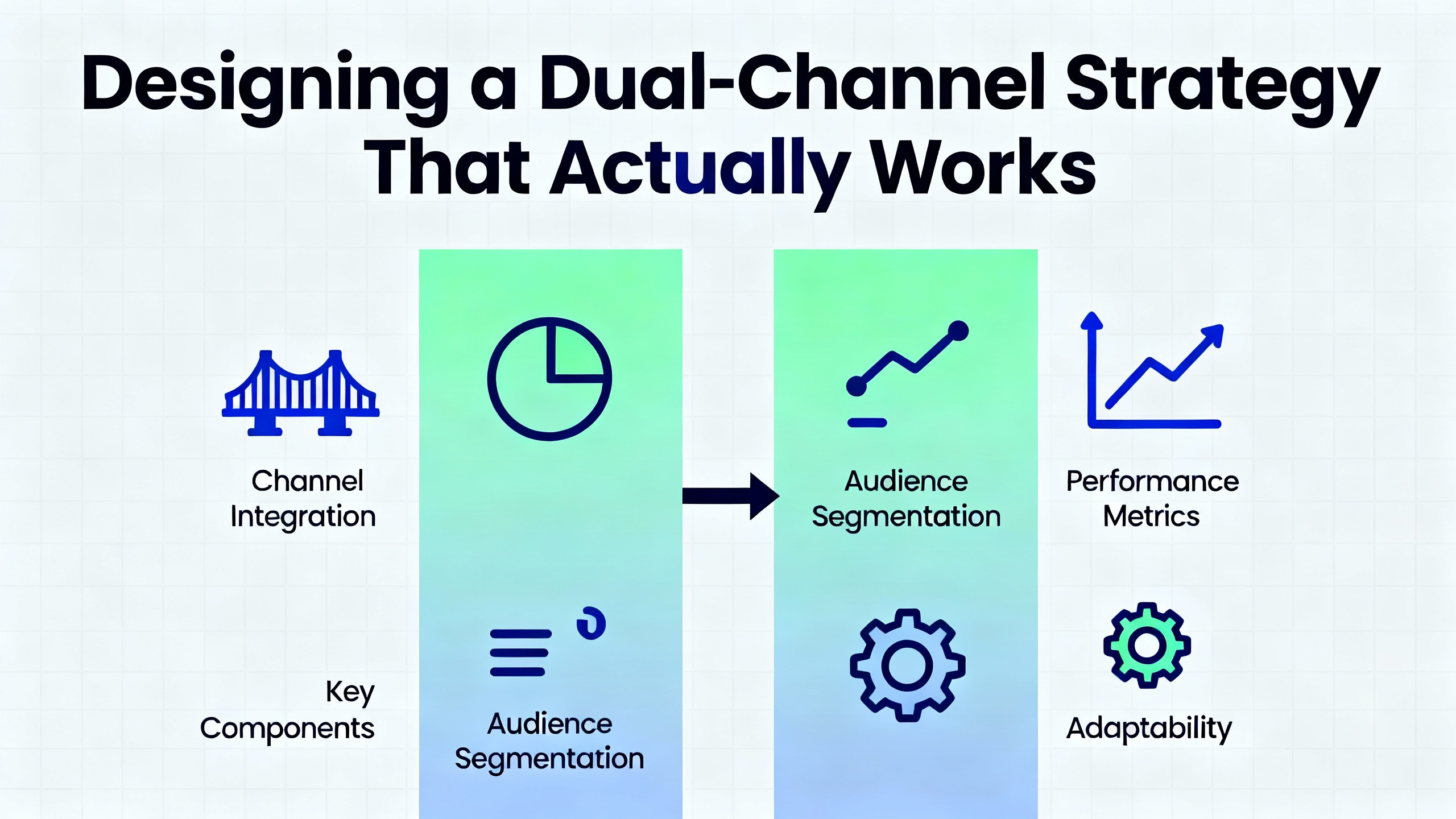

The research consistently recommends treating independent distributors as part of a multiŌĆæsourcing strategy rather than as emergency-only suppliers. That aligns well with practical experience.

The starting point is segmentation. Use OEM and franchised channels as your primary route for planned demand, new product introductions, and high-volume standard parts where the OEMŌĆÖs roadmap, support, and warranty are core to your strategy. At the same time, formally designate independent or hybrid distributors for categories such as obsolete components, long-lead-time items, high-volatility semiconductors, and spot buys triggered by line-down events.

From there, align processes. For planned projects, keep your normal RFQ and sourcing flows. For exceptions, define a fast-lane process that allows engineering, maintenance, and supply chain to jointly approve independent sourcing when defined trigger conditions occur, such as an allocation notice, a line-down event, or an EOL bulletin.

Finally, build feedback loops. Suppliers like Smith and Ezkey already generate market intelligence; structure regular reviews where they present pricing and availability trends for the components that matter most to your control platforms. Combine those insights with internal failure data and OEM life-cycle information so that you can decide when to redesign, when to stock deeper, and when to lean more on the independent channel.

Given the risks around counterfeit and substandard parts, choosing the right independent partner is more important than whether you choose one at all.

Industry examples provide a concrete checklist. Modern Pumping Today notes that established independent distributors are used to being audited by OEM customers and that these audits help strengthen their quality systems. Fusion Worldwide highlights a culture of transparency, inviting customers to tour facilities and review testing procedures. Microchip USA and Rand Technology emphasize certifications such as ISO 9001, AS9120, and AS6081, coupled with rigorous inspection and testing processes.

For a plant or OEM focused on industrial automation, a pragmatic approach is to start small. Select a limited set of nonŌĆæsafetyŌĆæcritical parts or secondary applications and run a trial phase with one or two vetted independents. During that phase, audit their incoming inspection records, test reports, and chain-of-custody documentation. Verify that their processes integrate with your own quality management system, especially around nonconformance reporting and corrective action.

As confidence grows, expand the scope to cover more critical components with commensurate testing and oversight. The goal is not to replace your OEM partners but to embed a second set of capabilities into your supply chain, backed by evidence rather than hope.

One common concern is that using independent distributors will upset OEMs or conflict with their channel strategies. Research on industrial channels and on dealerŌĆōOEM dynamics in other industries shows that OEMs already operate in complex hybrid models, balancing direct, dealer, and distributor sales. Their primary concern is usually protecting their brand and avoiding true gray-market abuse, not preventing legitimate, wellŌĆæcontrolled sourcing that keeps your lines running.

Another worry is warranty. In many cases, buying a PLC or HMI from an independent distributor rather than an authorized one may affect the OEMŌĆÖs willingness to warranty that specific unit, especially if they cannot verify its origin. That is why independents emphasize their own quality and limited warranty programs and why you should align such purchases with your risk appetite. For safetyŌĆæcritical or regulatoryŌĆæcritical applications, you may decide that OEM-only sourcing remains nonŌĆænegotiable. For less critical spare parts in nonŌĆæregulated environments, an independent route might be a rational tradeŌĆæoff to avoid downtime.

A third objection is complexity. Adding more suppliers means more vendor management work. The experience from companies like J2 Sourcing, Smith, and Sensible Micro, however, suggests that well-chosen independents can actually enable vendor consolidation by handling multiple component categories and even helping you clean up fragmented spend.

It increases some kinds of risk and reduces others. If you pick a low-quality broker, you increase quality and counterfeit risk. If you qualify a reputable independent distributor with strong certifications, testing, and traceability, you reduce supply and obsolescence risk while keeping quality risk within acceptable bounds through structured controls.

The research does not show OEMs cutting off customers simply for using independent distributors, and in many sectors OEMs rely heavily on thirdŌĆæparty channels themselves. What they care about is protecting their brand and avoiding unauthorized rebranding or misrepresentation. It is still wise to keep transparent communication with your OEM representatives, especially on critical platforms.

You should be very cautious with independent sourcing for safetyŌĆærelated components, lifeŌĆæcritical applications, and highly regulated environments unless you have a robust qualification program, thirdŌĆæparty testing, and clear internal approvals in place. In those cases, OEM or authorized channels often remain the default, with independents used only under tightly controlled circumstances.

Independent distributors are not a magic bullet, and OEM channels are not obsolete. From the control room to the boardroom, the plants that ride out shortages and obsolescence best are those that treat independent distribution as a deliberate part of their strategy, backed by quality systems, data, and clear rules of engagement. When you get that balance right, your PLCs, HMIs, and drives are no longer at the mercy of a single supply route, and your next lineŌĆædown call has more than one credible path to a solution.

Leave Your Comment