-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

When a line is down, no one in the plant cares what logo is on the shipping label. They care about how fast you can get the right module, load the right PLC program, and prove the line is safe to restart. That is where your choice between suppliers like Moore Automated and EU Automation really shows up in the real world: in minutes of downtime and in how much risk you are willing to carry.

In this article I will compare these two options the way I would as an on-site automation engineer, but with an important caveat. The research in front of me does not contain hard, published data about Moore Automated or EU Automation specifically. I am not going to guess about their warehouse locations, revenue, or service policies. Instead, I will treat them as two real vendors on your shortlist and walk you through how to evaluate their service and supply capabilities using proven industrial automation best practices from sources such as AWS, Delta Wye Electric, JHFOSTER, Autodesk, Rockwell Automation, and others. You can then apply this framework directly when you talk to each sales engineer.

Industrial automation is no longer a ŌĆ£nice to haveŌĆØ productivity booster. Multiple sources now describe it as a strategic necessity for staying competitive. Loenbro cites a McKinsey estimate that automation systems can raise productivity by up to 30 percent while reducing operational costs and human error. Autodesk reports that the industrial automation market is projected to grow from $206.33 billion in 2024 to $378.57 billion by 2030, roughly a 10.8 percent annual growth rate. In parallel, more manufacturers are reshoring work to the United States, which increases pressure to match global productivity through automation rather than low-cost labor.

At the same time, the technical stack has become far more complex. Plants now deploy a mix of PLCs, robots, conveyors, motion systems, vision, and IIoT devices. According to AWS, most of that logic still lives in vendor-specific IDEs and IEC 61131-3 languages such as ladder diagram, function block diagram, and structured text, often stored on engineer laptops or a shared drive instead of proper DevOps tooling. Delta Wye Electric shows how many different protocols engineers must consider, from PROFINET and EtherNet/IP to Modbus TCP, EtherCAT, OPC UA, and PROFIBUS, each with its own strengths, limitations, and best-use cases.

All of this means your service and supply partner is not just a catalog. They are part of your risk management strategy. The wrong protocol choice can cost millions in integration problems and downtime. The wrong power quality or code backup strategy can turn a brief sag into a day of lost production. A comparison between Moore Automated and EU Automation only makes sense if you evaluate them against that broader context.

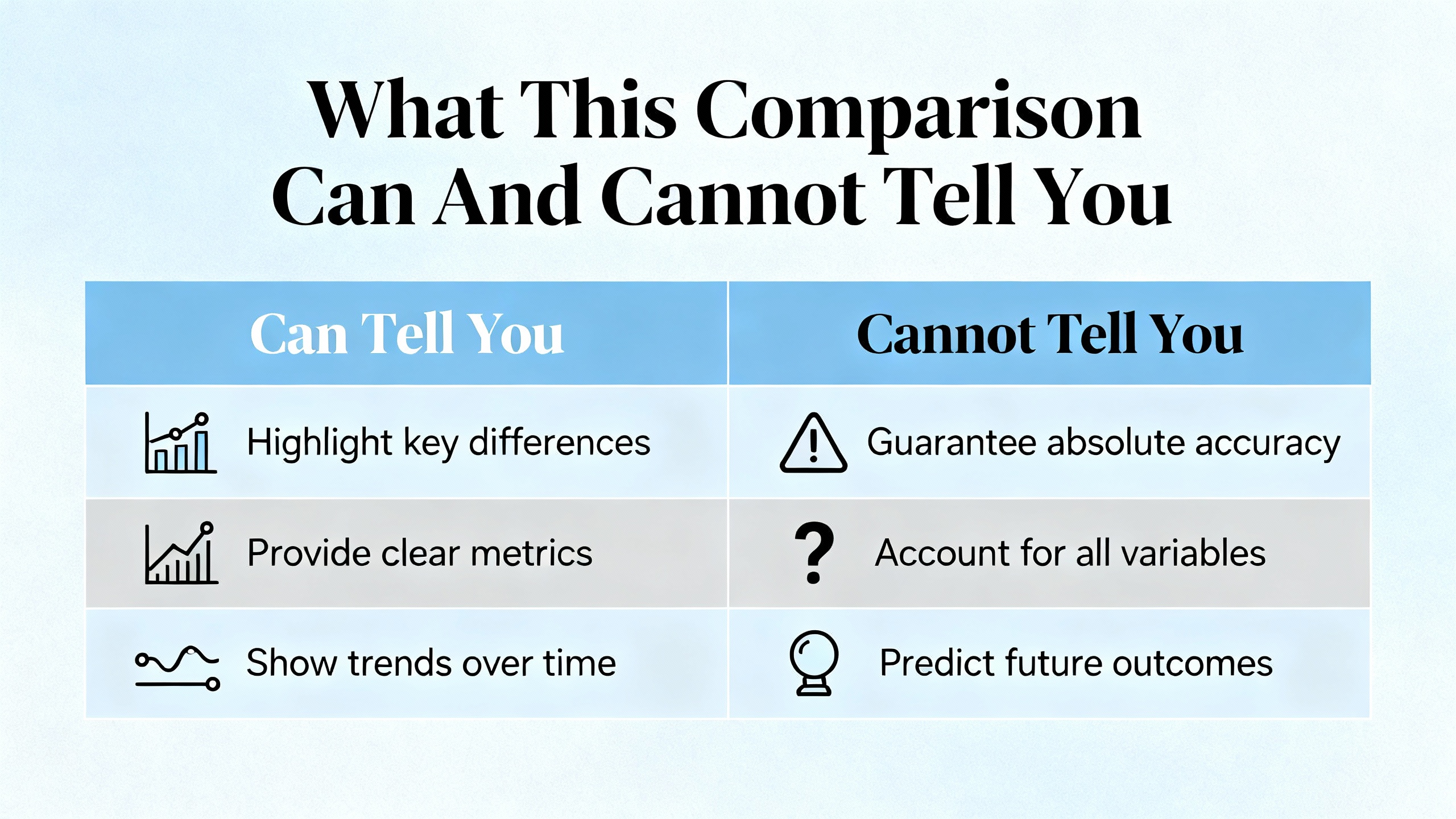

To stay honest and useful, I need to be explicit about the limits of this article. The research provided includes deep material on industrial automation, code management, protocols, and power systems, but it does not include documented profiles of Moore Automated or EU Automation. I do not have a verified list of their facilities, exact lead times, or contractual terms.

So I will not tell you ŌĆ£Moore Automated is better at XŌĆØ or ŌĆ£EU Automation is worse at Y.ŌĆØ That would be fabrication, not engineering. Instead, I will show you which questions matter, what good answers look like, and how those answers tie back to real best practices documented by reputable sources. When you sit down with account managers from Moore Automated and EU Automation, you can use this as a checklist and a decision framework grounded in field reality, not marketing slides.

With that understood, let us look at the two big sides of the decision: service capability and supply capability, then overlay digital maturity.

From my perspective on the plant floor, service capability usually matters before supply capability. Plenty of vendors can ship parts. Far fewer can walk into a cabinet at 3:00 PM on a Friday, sort out a messy blend of legacy fieldbus and industrial Ethernet, pull the right PLC or HMI program from the cloud, and bring the line back safely.

Modern automation code is not like general IT software. AWS describes how PLC and robot logic is bound up in proprietary binaries and IEC 61131-3 languages. Engineers deal with vendor-specific IDEs for Allen-Bradley, Siemens, Schneider, CODESYS, FANUC, and others. Historically, this code has been managed with ad-hoc practices: personal laptops, local file servers, thumb drives, and the occasional shared folder. When multiple plants and vendors enter the picture, simply finding the last known good version of a program can turn into a scavenger hunt.

When you compare Moore Automated and EU Automation, push hard on their PLC and HMI credentials. Ask which platforms they regularly work with. You want to see broad coverage across the typical ecosystem: discrete manufacturing PLCs, safety controllers, drive networks, and robot controllers. Copia Automation, cited by AWS, shows what a modern approach looks like: Git-based source control that understands vendor binaries, enables branching and merging, and can compare ladder logic visually. Even if neither supplier resells Copia, they should be comfortable working in that kind of disciplined workflow.

In practical terms, look for evidence that their engineers can structure projects, comment logic clearly, and use simulators or emulators in the cloud, the way AWS recommends, to test changes before deployment. If a vendor cannot explain their approach to version control, pull requests, and code review for PLC logic, they are not ready to be your first call for a complex failure.

As Delta Wye Electric points out, industrial automation protocols are essentially the languages your equipment uses to talk. Choosing poorly can cost you millions in integration headaches, downtime, and lost productivity. Vendors must understand not only the names of the protocols but their performance envelope and ideal use cases.

For example, PROFINET is often preferred in discrete manufacturing when deterministic real-time communication and tight motion control are required. EtherNet/IP dominates many North American plants, especially those built around Rockwell Automation platforms. Modbus TCP remains common for SCADA and basic monitoring because of its simplicity and broad device support. EtherCAT shines in ultra-fast motion systems. OPC UA is critical when bridging OT and IT, enabling secure, semantically rich communication from sensor to cloud. PROFIBUS and PROFIBUS PA still anchor many process and hazardous-area installations.

In a service comparison, you are not trying to turn Moore Automated or EU Automation into protocol evangelists. You are trying to assess whether they know enough to protect you from bad choices. Listen for whether they talk about determinism, cycle times, network segmentation, and total cost of ownership, as Delta Wye does, rather than only listing protocol names. Ask how they handle mixed environments during upgrades, for instance when moving from PROFIBUS to PROFINET while keeping some field devices online.

If you have ever watched a robot freeze mid-move because of a short voltage sag, you understand why JHFOSTER emphasizes power quality as a foundation for automation. The article from JHFOSTER explains that even momentary issues can cause equipment stops, data loss, and safety hazards. Good power systems minimize downtime, extend equipment life, prevent data corruption, and maintain the integrity of safety systems like light curtains and emergency stops.

When evaluating service capability, look at how Moore Automated and EU Automation talk about power. Do they treat it as a utility assumption or as part of the automation design? Competent partners should discuss stable voltage levels, overload protection, surge protection, and backup power. They should be comfortable specifying high-quality power supplies, uninterruptible power supplies for controlled shutdowns, and clear testing and maintenance routines.

An integrator-minded supplier will also care about scalability, recognizing that as you add robots, drives, and smart devices, the electrical system must keep up. In my experience, vendors who gloss over grounding, shielding, and panel layout often leave you with intermittent, hard-to-diagnose failures that show up as ŌĆ£randomŌĆØ faults in the PLC. That is not what you want from a primary service partner.

Several sources, including Loenbro and Norwalt, stress preventive maintenance, data integrity, and compliance in regulated industries such as pharmaceuticals and medical devices. In these environments, the wrong change can trigger more than downtime. It can trigger product holds, recalls, or regulatory findings.

Ask both Moore Automated and EU Automation how they handle change management and documentation. Good answers will reference written procedures for change requests, impact assessment, test plans, and rollback strategies. They should produce as-built drawings, updated IO lists, and revised functional descriptions after projects, not just leave you with a new program file and a handshake.

In the safety realm, automation vendors should show familiarity with electrical safety devices, risk assessments, and safety PLCs. They should also be willing to adhere to your lockout, tagout, and permitting processes without cutting corners to save a few minutes. A partner who manages documentation and safety rigorously is much more likely to stand behind you during audits and investigations.

Once you are confident that a vendor can solve technical problems, the next question is whether they can get you the hardware you need, when you need it, at a risk level your business can tolerate.

Automation case studies from Baker Industries, Pacific Blue Engineering, and others highlight how deeply production depends on reliable components such as sensors, drives, PLC CPUs, network switches, and specialized actuators. Automation can cut labor costs and improve throughput, but when a critical component fails with no spare on hand, all those efficiency gains disappear until you get a replacement.

Your comparison between Moore Automated and EU Automation should start with how each company thinks about parts stocking. You are looking for more than ŌĆ£we can source anything.ŌĆØ Ask about typical lead times for the brands you rely on. Probe how they handle urgent breakdown orders versus planned maintenance replenishment.

Efficient automation warehouses, as described in material from Pacific Blue Engineering, rely on integrated systems to coordinate robots, AS/RS, and material-handling equipment. While you do not need your supplier to run a showpiece warehouse, you do want them to use systems that track stock levels accurately and link to carrier data so promised ship dates are realistic.

From a plant perspective, the real question is how a supplier helps you balance the cost of holding spares on-site against the cost of waiting for replenishment. A strong partner will work with you to identify truly critical items, recommend minimum on-hand quantities, and use their own stocking to cover the less critical but still important parts. The weaker partner will simply send you a spreadsheet and leave the risk entirely in your lap.

Most plants do not have the luxury of a single-vendor environment. Many have an EtherNet/IP backbone with pockets of Modbus RTU over serial, PROFIBUS segments in process areas, and standalone machines using EtherCAT or proprietary networks. Delta WyeŌĆÖs discussion of protocols and migration paths shows how messy this can get when you try to modernize.

On the supply side, this means you should assess whether Moore Automated and EU Automation can support both modern and legacy hardware. That does not mean you should cling to every obsolete device forever, but you do need a controlled migration path. Ask each vendor how they have supported previous customers through stepwise migrations, for example, from PROFIBUS PA transmitters to PROFINET field devices, or from old Modbus-only gateways to units that support both Modbus TCP and OPC UA.

You should also check whether they can advise you on when it is smarter to keep buying legacy replacements versus when it is time to invest in a new platform. Some suppliers are purely transactional. Others act more like partners, helping you calculate total cost of ownership, including energy usage, downtime risk, and maintenance effort.

Automation authors like IBT and Autodesk highlight how automation adoption patterns differ between small and mid-sized manufacturers and very large enterprises. Many United States manufacturers have fewer than 100 employees, which means limited internal engineering staff and a heavy reliance on external partners.

When comparing Moore Automated and EU Automation, think about whether your footprint is single-site, regional, or global. A supplier with strong local presence can be worth a great deal during a crisis, even if their catalog looks similar to a larger playerŌĆÖs online offering. Conversely, if you operate multiple plants across different states or countries, the ability to support common standards and coordinate spares strategies across sites becomes a major differentiator.

This is not about naming one vendor the ŌĆ£localŌĆØ and the other the ŌĆ£globalŌĆØ option, because that depends entirely on your locations. It is about matching their real footprint to yours and being realistic about how quickly they can get human beings as well as boxes to your plant.

The most interesting change in automation services over the last few years is the shift toward treating code and data as first-class assets. AWS encourages manufacturers to adopt software-style lifecycle management for PLC and robot code, using version control, pull requests, and cloud-hosted repositories. Pacific Blue Engineering and Rockwell Automation describe how IIoT, edge computing, and cloud analytics enable real-time monitoring, predictive maintenance, and digital twins.

When you compare Moore Automated and EU Automation, you should not ignore this dimension. In many plants I work with, the bottleneck is no longer finding a replacement module. It is finding the correct version of the program that ran on that module before it failed.

AWS and Copia Automation outline a pattern that has saved more than one plant from disaster: scheduled, automated backups from devices into a central, cloud-based repository with history and diff capabilities. CopiaŌĆÖs DeviceLink, for example, can pull programs from Allen-Bradley, Siemens, Schneider, CODESYS, and FANUC devices on a schedule, compare them to the last known version, and flag changes. When a PLC dies, you restore the right program quickly instead of guessing.

Ask Moore Automated and EU Automation whether they can work within such an environment. Do they support or offer cloud-based backup solutions for PLC and robot programs? Are they comfortable handling Git workflows for IEC 61131-3 code, including branching, merging, and code review? Have they worked with AWS-hosted emulators or simulators to test logic before deployment, as recommended in AWSŌĆÖs best practices?

If one vendor leans into these practices and the other shrugs them off as ŌĆ£IT stuff,ŌĆØ that is a meaningful difference in service maturity. In a modern plant, a provider that understands code lifecycle management is far more valuable than one that only swaps hardware.

Edge computing and IIoT, described by Autodesk, Rockwell Automation, and others, enable near real-time data collection and analysis right at the machine, with the cloud providing scalable storage and heavy analytics. Pacific Blue Engineering highlights how this combination can improve warehouse throughput, predictive maintenance, and quality by orders of magnitude.

In a service and supply comparison, ask each vendor how they use data and remote access to support you. Can they tap into your IIoT platform, OPC UA servers, or historian to see alarm histories, trends, and quality metrics before they send a technician? Are they comfortable working with secure remote access tools, following your cybersecurity policies, rather than demanding direct, unsecured VPN tunnels?

Look for alignment with recognized security practices. Imaginovation and other sources stress the importance of encryption, multi-factor authentication, network segmentation, and secure protocols when connecting automation assets to the wider network. A vendor that treats security as a nuisance, rather than a design requirement, can expose you to risks far beyond a single bad day of downtime.

The table below summarizes how to structure your conversations with Moore Automated and EU Automation. It does not pre-judge their answers. Instead, it shows what you should be listening for and why it matters.

| Dimension | Why It Matters | Questions For Both Vendors |

|---|---|---|

| PLC and HMI expertise | Most real failures involve logic, not just hardware; IEC 61131-3 skills and familiarity with vendor IDEs directly influence recovery time. | Which PLC and HMI platforms do your engineers support regularly, and how do you manage program versions and changes over time? |

| Network and protocols | Wrong protocol choices and poor designs can add years of hidden cost, as Delta Wye Electric warns. | How do you approach protocol selection among PROFINET, EtherNet/IP, Modbus TCP, EtherCAT, OPC UA, and PROFIBUS for different applications, and how do you manage migrations? |

| Power quality and electrical design | JHFOSTER shows that unstable power causes downtime, equipment wear, data loss, and safety issues. | How do you address power quality, surge protection, backup power, grounding, and panel design when you install or support automation systems? |

| Safety and compliance | Regulated industries and high-risk environments demand disciplined change control and safety practices. | What is your process for documenting changes, performing risk assessments, and ensuring that safety systems remain effective during upgrades or repairs? |

| Spares strategy and lead times | The balance between on-site stock and vendor-held inventory determines your downtime exposure. | How do you help customers define critical spares lists, minimum on-hand quantities, and realistic expectations for expedited shipments? |

| Legacy and multi-vendor support | Mixed environments with old and new devices are the rule, not the exception. | How have you supported customers with legacy protocols and devices during stepwise modernization, and what criteria do you use to recommend replacement versus continued support? |

| Digital code management | Cloud-based backups and Git workflows shorten recovery and reduce errors, as highlighted by AWS and Copia Automation. | Do you support automated backups from PLCs and robots into a version-controlled repository, and can your engineers work within Git-based review and deployment processes? |

| Data, IIoT, and remote diagnostics | IIoT and edge analytics improve maintenance and quality while reducing truck rolls. | How do you use plant data, historians, or IIoT platforms to diagnose issues remotely and plan interventions, and how do you align this with cybersecurity requirements? |

| Partnership model | Automation is a long-term journey, not a single project, as many sources emphasize. | How do you structure ongoing support, training, and continuous improvement engagements rather than one-off part sales or projects? |

Use this table as a conversation script. Take notes on how each vendor responds, and then compare their answers to the best practices summarized earlier.

Different plants need different things from a supplier. Two vendors can both be competent and still be a poor or excellent fit depending on your context. The industrial automation articles in the research set suggest several patterns that are worth considering.

If you are running a single-site, high-mix discrete manufacturing operation, your priorities likely include rapid changeovers, flexible automation, and strong local troubleshooting support. Articles on flexible automation and collaborative robots stress that such plants benefit from integrators who can reconfigure systems frequently and safely. In that case, you might prioritize whichever vendor shows deeper PLC, HMI, and robot programming expertise and is willing to be on-site quickly, even if their global logistics footprint is modest.

If you operate multiple sites with a mix of legacy fieldbus and newer industrial Ethernet, protocol and migration expertise become decisive. Delta Wye Electric and others describe careful, phased strategies for moving from PROFIBUS to PROFINET or integrating OPC UA on top of existing infrastructure. Here, you want the supplier that can articulate a multi-year plan, coordinate spares and standards across plants, and help you avoid forked configurations that drift apart.

If you are in a heavily regulated process industry, such as pharmaceuticals or food and beverage, everything about data integrity, traceability, and validation moves to the top of the list. JHFOSTER highlights how power failures can compromise data, while AWS and Autodesk emphasize the importance of version-controlled code and digital twins. In this world, you want the vendor whose documentation, testing, and change-control culture survives a formal audit, not just a quick plant tour.

In all cases, remember that automation is not a one-time project. Sources such as AIL and Kundinger encourage companies to treat automation as a continuous improvement journey, combining careful planning, pilot projects, staff training, and feedback loops. When you evaluate Moore Automated and EU Automation, look at how each one talks about the next three to five years, not just the next shipment.

In many plants, the best answer is a cautious ŌĆ£yes, but with clear lines.ŌĆØ Some companies choose one vendor primarily for parts supply and another for integration and service, especially if no single company convincingly covers both. That can work well if you maintain clear responsibility boundaries and ensure that your integrator is not locked out of competitive pricing on hardware.

However, splitting purely to play vendors against each other on price can backfire. If neither side sees a long-term relationship, you may find yourself with shallow support from both. Whichever path you choose, make sure at least one partner views your automation stack as a system instead of a shopping list.

Several sources in the research note that automation can reduce operational costs and downtime significantly when implemented well. The right question is not ŌĆ£Which quote is lower?ŌĆØ but ŌĆ£Which partner will reduce our unplanned downtime and integration risk more over the next few years?ŌĆØ Even modest improvements in uptime or quality often outweigh a small difference in part markup or hourly rates.

One practical approach is to estimate downtime cost per hour for each major line and work backward. Then ask Moore Automated and EU Automation for examples of how their approach to power quality, code management, or protocol selection has reduced downtime for other clients, referencing practices like cloud code backups, IIoT-based diagnostics, or better network designs described by AWS, Delta Wye Electric, and Pacific Blue Engineering.

No decision is perfect, but you can reduce risk. Start with a pilot engagement that is meaningful but bounded, such as a controls refresh on one line, a network modernization in a single area, or implementation of a code backup solution for a subset of PLCs. Use the criteria in this article to evaluate performance: technical quality, documentation, communication, and real impact on uptime and maintainability.

If a vendor performs well, you expand the relationship. If they fall short, you have limited the blast radius and learned exactly what to ask the next candidate.

From the plant floor, the difference between Moore Automated and EU Automation will not be decided by catalog thickness alone. It will be decided by who shows up with the right spare at 2:00 AM, who can restore the correct PLC program from a secure backup, who understands your network and power system well enough to prevent repeat failures, and who treats your automation stack as a long-term partnership rather than a series of isolated orders. Use the questions and principles in this article, grounded in proven best practices, and you will be well equipped to pick the partner that keeps your lines running and your risk under control.

Leave Your Comment