-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

When a PLC power supply dies at 2:00 AM and the line is down, you do not care which logo is on the box. You care that the replacement is genuine, arrives when promised, powers up cleanly, and does not come back to bite you six months later. Companies like Moore Automated and Radwell International live in that critical space between your maintenance team and the global supply chain for automation hardware.

The research available here does not include companyŌĆæspecific data on Moore Automated or Radwell International, so this article will not pretend to rate or rank either one. Instead, I will walk through how an industrial automation engineer should evaluate any distributors in their position, using Moore Automated and Radwell International as concrete examples in the decision framework. The goal is to help you choose the right partner for PLCs, HMIs, drives, and control components, grounded in what current research says about automation, distribution, and reliability, and in the realities of keeping real factories running.

From the plant side, distributors are part of your control system whether you like it or not. Every time you accept a spare module, a refurbished drive, or an ŌĆ£equivalentŌĆØ sensor, you are changing the risk profile of your line. Research on supply chain automation from sources such as IBM, Appian, and Hartman Advisors consistently frames automation as a way to reduce manual, errorŌĆæprone work and increase visibility across the chain, not to replace people. That philosophy applies directly to how you work with Moore Automated or Radwell International.

Several independent sources highlight the same themes. IBM describes supply chain automation as technology that supplements human workers by offloading repetitive tasks and providing better data. Appian emphasizes using robotic process automation and intelligent document processing to remove manual data entry, route exceptions to people, and keep humans in charge of critical decisions. Hartman Advisors notes that aggressively digitizing and automating supply chains can boost earnings by around 3.2%, largely by improving visibility, speed, and workforce productivity. For you on the plant floor, those abstract benefits translate into fewer lost orders, fewer misŌĆæshipped parts, and fewer surprises when you energize a new component.

If a distributor behaves like a modern automated supply chain node, you will see quick, accurate data on availability, clear documentation, predictable shipping, and very few clerical mistakes. If it behaves like a manual spreadsheet and email operation, you will feel it in delays, wrong revisions, and constant corrective firefighting.

Different sources use different terms, but they are describing closely related ideas.

Supply chain automation, as described by IBM and Lowry Solutions, is the use of software, data analytics, robotics, and integration tools to run procurement, warehousing, transportation, and communication with minimal manual intervention. NetSuite and other sources emphasize the role of integrated platforms such as ERP systems, warehouse management systems, and transportation management systems. These systems automatically track inventory, trigger replenishment, optimize routes, and capture shipment status.

Automated distribution, in the language of ZINFI and Burns & McDonnell, is more focused on the physical movement and handling of goods. It combines warehouse management systems, automated storage and retrieval systems, conveyors, and robotics to move product from receiving to shipping with as little human handling as possible. Burns & McDonnell reports that wellŌĆædesigned automated storage and retrieval systems can cut paid walking time by up to 99%, and pallet, case, and piece handling solutions can reduce labor costs by as much as 85%. ZINFI highlights additional benefits: higher speed, better accuracy, scalability, and rich data for analytics.

Distribution automation in the power utility world, as described by EPRI, NEMA, and Cisco, is something different but philosophically similar. There, devices on the mediumŌĆævoltage network are automated and monitored in real time to improve reliability, protect critical loads, and reduce outage time. Utilities invest in sensors, controllers, and communications to know what is happening on the grid and to act quickly when something fails.

Across these domains the pattern is the same. Automation is about turning opaque, manual, reactive processes into transparent, dataŌĆædriven, proactive ones.

The research converges on several benefits that you should expect distributors to deliver if they are serious about automation.

Speed and throughput are first. Docparser cites warehouse studies where over half of companies are investing in robotics such as automated storage and retrieval systems, smart forklifts, and sortation systems. Hartman Advisors reinforces that automation improves speed to market by optimizing inventory positioning and routing. In practice, that means your order for a replacement PLC rack or HMI should move quickly through their system without sitting in someoneŌĆÖs email queue for a day.

Accuracy is equally important. Docparser highlights that businesses lose more than $600 billion each year to data entry errors across procurement and supply chain operations. Surgere notes sourcing data showing that teams using automation see roughly 56% fewer errors. When that ŌĆ£errorŌĆØ is the wrong firmware revision on a safety PLC, the cost is more than just paperwork. Automated data capture and standardized workflows at the distributor reduce the chances that your order gets keyed incorrectly or matched to the wrong catalog variation.

Visibility and transparency appear in almost every source. Hartman Advisors, Bizagi, and NetSuite all stress realŌĆætime visibility into inventory and orders. BizagiŌĆÖs case studies show companies like Adidas and DHL using lowŌĆæcode automation platforms to eliminate huge volumes of manual emails, cut onboarding times, and give both employees and customers a clear view of status. For you, that should look like live stock information, clear lead times, and trackable shipments from distributors.

Cost and resilience round out the picture. Hartman notes that most supply chain leaders now treat automation as a strategic imperative, not a tactical upgrade, specifically because it improves margins while making the chain more resilient to shocks. NetSuite points out that a large majority of executives report recent supply issues and are targeting supply chain and manufacturing for cost reduction through automation. When you evaluate Moore Automated and Radwell International, you are also deciding how your site participates in that broader shift: are you plugging into a resilient, automated network, or into a brittle manual process?

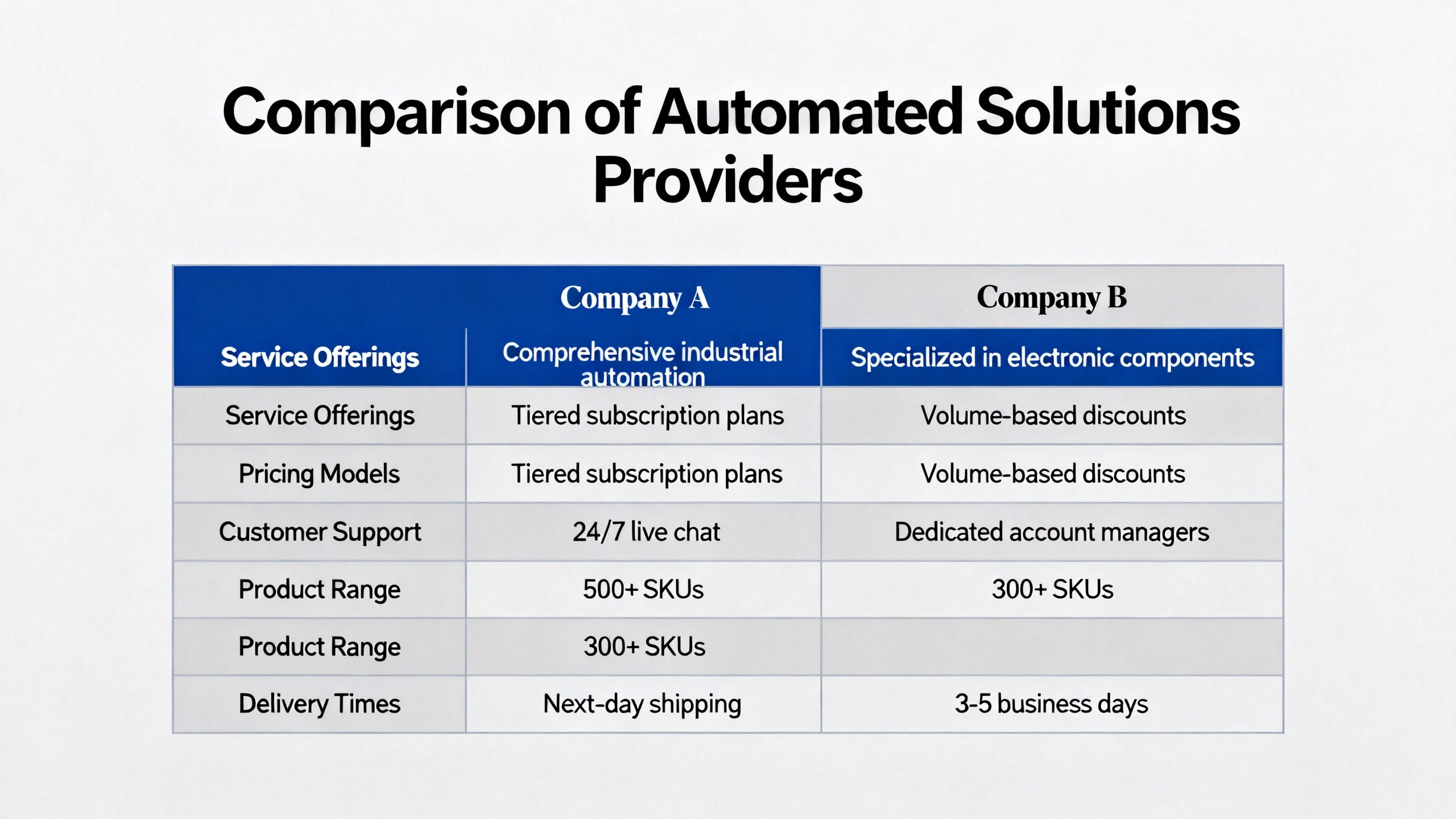

Without companyŌĆæspecific research, the only honest way to compare Moore Automated and Radwell International is to frame the categories where differences typically matter and show how to interrogate each vendor. In practice, most automation distributors fall somewhere along a continuum between highŌĆævolume multiŌĆæbrand aggregators and more specialized or niche suppliers. The right answer depends on your plantŌĆÖs risk tolerance, standardization strategy, and maintenance philosophy.

On site, what matters is not the marketing pitch but the behavior under stress. A good distributor, whether it is Moore Automated, Radwell International, or anyone else, should behave like a wellŌĆæengineered control system. Inputs are your purchase orders, part numbers, failure reports, and forecasts. Internal logic is their combination of automation, data, and people. Outputs are correct, authentic parts delivered on time, with traceability and support.

The rest of this comparison will use both names explicitly, but you should read every statement as ŌĆ£this is what you should find out about Moore Automated and about Radwell International, not a claim that they already do or do not meet the bar.ŌĆØ

Availability is your first filter. Research from Hartman Advisors and Inbound Logistics shows that realŌĆætime, networkŌĆæwide inventory visibility is central to modern supply chains. For an automation distributor this means they should know, in real time, where a given PLC CPU, I/O card, or HMI is located, how many units are available, and what the realistic ship date will be.

When you speak with Moore Automated, ask how they represent stock information and lead times, and whether their figures are integrated with automated warehouse systems or updated manually. Ask the same questions of Radwell International. You are looking for consistency between what the sales portal shows, what the salesperson tells you, and what actually arrives at your dock. Any large gap indicates weak internal automation and higher risk for you.

For critical spares, also clarify how each distributor handles split shipments and multiŌĆæsite logistics. Research on supply chain control towers and digital twins, cited by Inbound Logistics, shows that advanced planning tools let companies respond to disruptions quickly. In your context, that flexibility translates into a distributor who can reroute stock from another region, arrange direct dropŌĆæship from an upstream source where appropriate, and provide clear communication while doing it.

The research notes do not discuss specific brands, but they underline the importance of standardized, automated quality processes. NEMAŌĆÖs description of distribution automation in utilities emphasizes asset optimization, monitoring, and lifecycle performance. EPRIŌĆÖs work on recloser lifeŌĆæcycle management shows that understanding failure modes and performing systematic testing is vital to safe, reliable operation.

You should expect similar discipline around refurbished or surplus industrial automation parts. With Moore Automated, ask how they classify inventory into new, surplus, refurbished, or repaired. Request details of their testing process, especially for safetyŌĆærelated modules and network components. With Radwell International, ask what documentation accompanies refurbished items, how test reports are stored, and whether serial numbers and firmware revisions are tracked in a database rather than in spreadsheets.

The critical point is traceability. An engineer on the night shift needs to know whether the spare ControlLogix module in the crib is factory new, thirdŌĆæparty refurbished, or repaired, and where it came from. Automation research repeatedly stresses that clean, consistent data is the foundation of reliable operations. That applies equally to your asset management system and to the distributor feeding it.

Several sources, including Docparser, Appian, Bizagi, and Lumenalta, talk at length about automating documentŌĆæheavy processes such as purchase orders, shipping notes, and invoices. The reason is simple: manual data entry is slow and errorŌĆæprone. Docparser cites research where companies lose hundreds of billions of dollars annually to data errors in procurement and supply chain operations. BizagiŌĆÖs customers have eliminated massive volumes of email by integrating systems and automating workflows.

When you evaluate Moore Automated and Radwell International, pay close attention to how they handle documentation. At a minimum, you should be able to receive electronic packing lists, certificates of conformity, test reports for refurbished units, and structured data feeds you can tie into your own maintenance and ERP systems. If one distributor can only fax or email PDFs while the other supports electronic data interchange or modern APIs, the longŌĆæterm cost and risk difference is real.

From an onŌĆæsite problemŌĆæsolver perspective, the most important question is simple. When something fails in the field and management asks what was installed, when, and where it came from, can you answer in minutes because the data from your distributor is clean and integrated, or do you have to dig through paper binders and shared drives?

UtilityŌĆæside research from EPRI, Cisco, Xylem, and Eaton highlights intensive laboratory testing, failure analysis, and health monitoring for distribution automation assets. Failures in those systems can pose safety risks and broad outages, so utilities work with vendors who can provide not only equipment but also deep lifeŌĆæcycle support, including forensic analysis of failures.

While a failed PLC output card might not black out a city, it can still cause significant safety, quality, and financial issues in an industrial plant. For both Moore Automated and Radwell International, you should ask how they handle warranty and postŌĆæfailure support. Helpful questions include how they manage returns and whether they perform diagnostic testing on failed units, how quickly they can provide a failure analysis summary, and how findings are fed back into their own quality system.

Companies that invest in failure analysis and feedback loops usually invest in upstream automation and process control as well. That alignment reduces the chance that you see repeat issues from the same failure mode.

Modern research on supply chain automation, from IBM to NetSuite, makes a clear point. The big gains come when systems connect end to end so that data flows automatically, rather than being reŌĆækeyed at every handoff. Lumenalta describes robotic process automation as a way to bridge disconnected digital systems, handling repetitive tasks like order processing and shipment tracking by mimicking human clicks and keystrokes. Bizagi and others show how lowŌĆæcode platforms can orchestrate complex workflows across multiple systems.

In practical plant terms, this means you want distributors that support electronic ordering and status integration. With Moore Automated, ask whether they can provide order status feeds you can consume in your system, or whether they support any form of machineŌĆæreadable acknowledgment and shipping notice. Ask Radwell International similar questions. Even if you start with emailed PDFs today, knowing that the distributor is already wired for automation will make it easier to layer your own RPA or lowŌĆæcode workflows later.

The table below is not a scorecard; it is a checklist of conversations you should have with each distributor. It translates the research themes into concrete questions and describes what ŌĆ£goodŌĆØ looks like from an automation engineerŌĆÖs perspective.

| Criteria | Questions for Moore Automated | Questions for Radwell International | What good looks like |

|---|---|---|---|

| Inventory depth and reach | Ask how realŌĆætime stock and lead times are generated and updated. | Ask how stock visibility is maintained across warehouses and sites. | Consistent, realŌĆætime inventory data and realistic lead times that match deliveries. |

| Product authenticity and quality | Ask how they verify authenticity and classify new vs refurbished. | Ask how they test, certify, and label surplus or repaired units. | Clear categories, documented tests, and traceable serials and firmware revisions. |

| Documentation and data | Ask which documents and data formats are available electronically. | Ask what formats they support for packing lists and test reports. | Structured electronic data suitable for direct import into your systems. |

| Pricing and total cost | Ask how they handle rush orders and consolidated shipping. | Ask how they price refurbished options versus new components. | Transparent pricing aligned with total cost of downtime and lifecycle risk. |

| Support and engineering help | Ask whether technical staff can advise on revisions and options. | Ask what engineering support is available for complex replacements. | Access to knowledgeable staff who understand PLC, HMI, and drive implications. |

| Returns and failure handling | Ask how quickly they process returns and analyze failures. | Ask what information they provide when a unit fails in service. | Fast, structured failure feedback that feeds into your reliability program. |

| Digital integration | Ask what electronic ordering and status interfaces they support. | Ask whether they can integrate with your ERP or maintenance tools. | Integration paths for future RPA or lowŌĆæcode workflows, not just manual email. |

Use this table as a working document in supplier review meetings. Fill in your own notes and evidence for each cell over time. In practice, one distributor may outperform the other on some criteria, and you might split your spend accordingly.

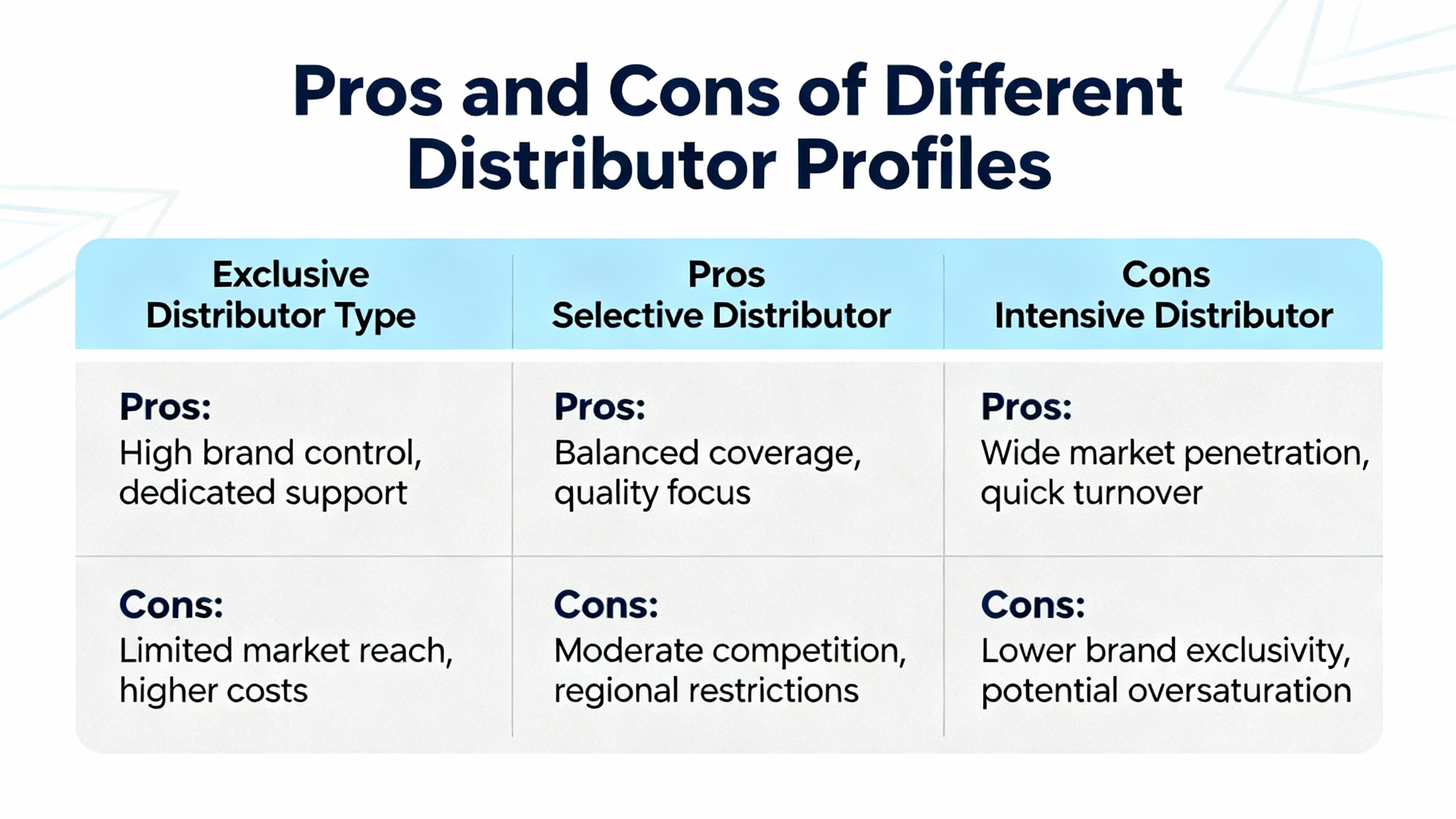

The research on supply chain automation and automated distribution hints at tradeŌĆæoffs you will typically see between different types of distributors.

Heavily automated, highŌĆævolume operations often excel at speed and price. Inbound Logistics mentions that by 2027, a large majority of companies are expected to adopt warehouse automation, and that robot prices have dropped significantly over the last decade while wages have risen. Those economics favor distributors who invest in robotics and dataŌĆædriven planning. For you, that can mean fast order picking, reliable tracking, and competitive pricing on common SKUs.

However, high automation does not automatically guarantee deep application knowledge or flexibility for oddball industrial cases. This is where more specialized or engineeringŌĆæfocused distributors can shine. They may not match the throughput of a vast automated warehouse, but they can help you navigate tricky questions like legacy firmware compatibility, migration paths for obsolete PLC families, and safe substitutions for discontinued drives.

The research from Bizagi and Lumenalta suggests a middle path. Organizations gain the most when they automate the highŌĆævolume, lowŌĆævalue tasks such as data entry and document handling, while keeping humans focused on complex, relationshipŌĆædriven work. When you evaluate Moore Automated and Radwell International, look for that balance. Ideally, routine transactions should feel frictionless and automated, while escalation to a human expert should be easy when you hit a complex application issue.

From the perspective of an onŌĆæsite problem solver, here is how I apply this researchŌĆædriven framework when the plant is at risk.

I start by scoping the technical requirement clearly. That means exact catalog number, firmware constraints, slot compatibility, and any safety or network considerations. This part is on you, not the distributor. The research on supply chain automation assumes upstream data is clean; you need to provide that clean input.

Next, I query both Moore Automated and Radwell International with the same structured request. I want them to tell me availability, part condition category, test history for any nonŌĆænew items, and realistic ship and arrival dates. I also ask for supporting documentation in electronic form. Based on the research from Docparser and Bizagi, I prefer distributors that can provide structured data rather than only unstructured emails and PDFs.

If the situation is truly urgent, I judge responses on both content and responsiveness. A distributor with strong internal automation and good processes will usually provide clear answers quickly because they are not hunting through spreadsheets manually. The Hartman Advisors and IBM material both highlight that automation shortens planning and response cycles; you should see that in how quickly they can tell you exactly what is possible.

Once I have options, I factor in risk. A refurbished or surplus module may be entirely acceptable for a nonŌĆæsafety application if the distributorŌĆÖs testing, documentation, and warranty are solid. The research on distribution automation in utilities shows how much value structured testing and failure analysis can add over the life of an asset. I expect similar rigor when someone is selling me a refurbished PLC or drive.

After installation, I treat the first few weeks as a proving period. If a module sourced through a particular channel fails prematurely, I capture that data and push it back into our supplier review. Over time, this creates your own internal evidence base that complements the generic research. You will see which distributorŌĆÖs promises line up with behavior under load.

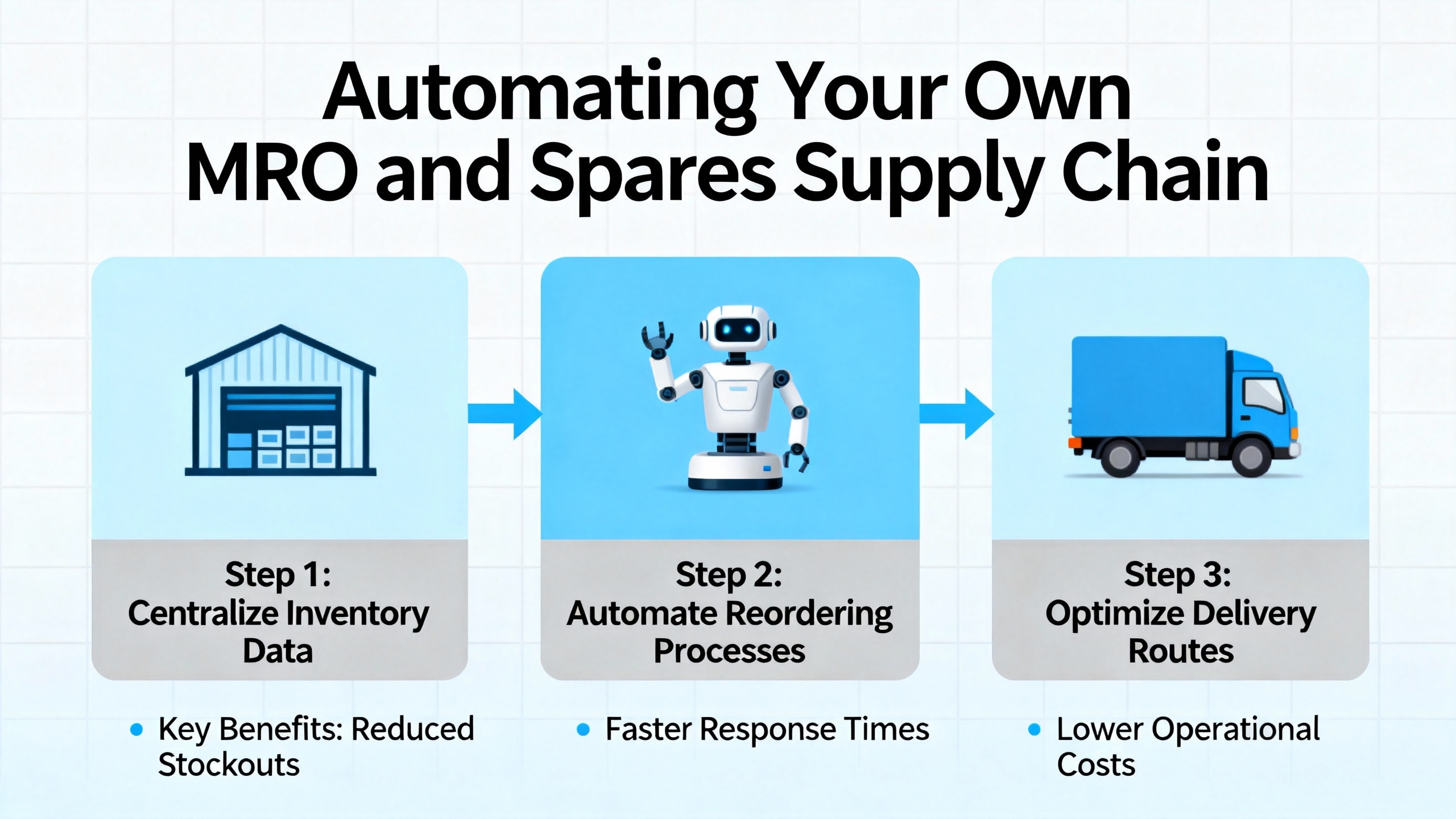

The research does not stop at what distributors should do. Many of the same automation techniques can be applied inside your maintenance, repair, and operations process.

Appian, Lumenalta, and Docparser all describe using robotic process automation and intelligent document processing to handle purchase orders, invoices, and inventory records. BizagiŌĆÖs case studies show organizations eliminating vast numbers of manual emails and reducing cycle times by building lowŌĆæcode workflows around their existing systems. Hartman Advisors and NetSuite stress that supply chain automation is now a strategic imperative, not an optional experiment.

For an automation engineer or maintenance manager, that suggests several practical moves. You can standardize how you capture part numbers, revisions, and condition codes from Moore Automated and Radwell International, making it easier to compare them objectively. You can use simple data capture tools to pull order confirmations and packing lists into your maintenance database without manual reŌĆæentry. You can automate reorder triggers based on real consumption rather than static minŌĆæmax levels, aligning with the demandŌĆædriven, realŌĆætime planning models described in the research.

Importantly, IBM and others note that automation should augment, not replace, people. The aim is to free your planners, buyers, and technicians from clerical tasks so they can focus on higherŌĆævalue work such as root cause analysis, obsolescence planning, and supplier development. When you engage with Moore Automated and Radwell International, position your initiatives that way. You are not just trying to squeeze prices; you are trying to build a more reliable, dataŌĆædriven ecosystem that benefits both sides.

Research from Hartman Advisors and NetSuite shows that resilient supply chains rely on coordinated networks of partners rather than single points of failure. In practice, qualifying at least two distributors, such as Moore Automated and Radwell International, and using clear evaluation criteria gives you more flexibility during shortages, obsolescence events, or logistics disruptions.

The research here does not address specific brands, but work from EPRI, NEMA, and Eaton on critical electrical equipment emphasizes the importance of rigorous testing, clear classification, and traceability for any nonŌĆænew assets. If a distributor can provide documented test procedures, serial tracking, and a meaningful warranty, refurbished equipment can be a sensible option in the right applications. The risk comes when condition is ambiguous and testing is opaque.

Given the evidence from Docparser, Surgere, and others on the cost of errors, many plants find that ŌĆ£right part, right revision, on timeŌĆØ is the most powerful combined metric. It captures accuracy, timeliness, and data quality in one measure. Once that is stable, you can layer in cost and support metrics without compromising reliability.

When you compare Moore Automated and Radwell International, do it the way you would evaluate a new PLC platform or safety relay. Define the requirements clearly, insist on data and traceability, and look for partners whose internal automation and processes make your plant more predictable, not less. In a world where supply chain automation is reshaping how inventory moves and how decisions are made, your choice of distributor is another control loop you can design, tune, and improve over time.

Leave Your Comment